Bitcoin Goes Mainstream: Block Launches Global Zero-Fee Merchant Payments

- Over 4 million Square merchants can now process Bitcoin payments globally.

- The service offers instant settlement and zero fees until 2027.

- Jack Dorsey’s Bitcoin-first strategy continues to reshape digital commerce.

- Analysts see this as a major step in bridging crypto and traditional finance.

More than 4 million sellers can now accept Bitcoin directly for goods and services, instantly converting it to fiat or keeping it as BTC—all without fees until 2027.

The new payment option can be activated straight from the Square dashboard, integrating seamlessly with existing checkout systems. Sellers have full control over how transactions are handled, choosing among BTC or fiat settlements, and even automating conversions based on a preferred percentage of daily sales. This move effectively removes one of the biggest barriers for businesses hesitant to deal with crypto volatility.

From Vision to Implementation

Jack Dorsey’s long-held ambition to make Bitcoin a practical global currency is finally becoming tangible. The company’s CEO shared the announcement on X, calling it a step toward blending open digital assets with mainstream finance. “Our sellers can now transact freely between Bitcoin and fiat,” Dorsey said, highlighting the flexibility that defines this rollout.

Bitwise CEO Hunter Horsley described the milestone as a signal that crypto’s integration into daily commerce is accelerating. His remark—“Zoom out: it’s all happening”—captures the broader industry sentiment that digital currencies are no longer confined to trading platforms or speculative markets.

A Strategic Leap Amid Earnings Pressure

The announcement comes shortly after Block’s third-quarter earnings, which showed mixed results. Despite reporting profits below Wall Street forecasts, overall payment volume rose 12% year-over-year—a sign that user engagement and transaction growth remain solid. The introduction of Bitcoin payments could help offset near-term revenue softness by attracting a new generation of tech-savvy merchants.

With Bitcoin now hovering around $105,000, the timing couldn’t be better. The integration not only positions Block as a bridge between crypto and traditional finance but also reinforces its role as one of the few fintech leaders betting big on blockchain-based commerce.

READ MORE:

Coinbase Unveils Platform for Early Token Sales

Expanding the Boundaries of Digital Payments

By allowing borderless, instant, and transparent transactions, Block is rewriting the rules of merchant payments. Analysts view the initiative as one of the most meaningful developments in digital finance this year—one that could push other payment providers to follow suit.

If successful, Square’s merchant ecosystem could become one of the largest real-world testbeds for cryptocurrency adoption, effectively bringing Bitcoin from wallets and exchanges into the cash registers of everyday businesses around the world.

The information provided in this article is for educational purposes only and does not constitute financial, investment, or trading advice. Coindoo.com does not endorse or recommend any specific investment strategy or cryptocurrency. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions.

The post Bitcoin Goes Mainstream: Block Launches Global Zero-Fee Merchant Payments appeared first on Coindoo.

You May Also Like

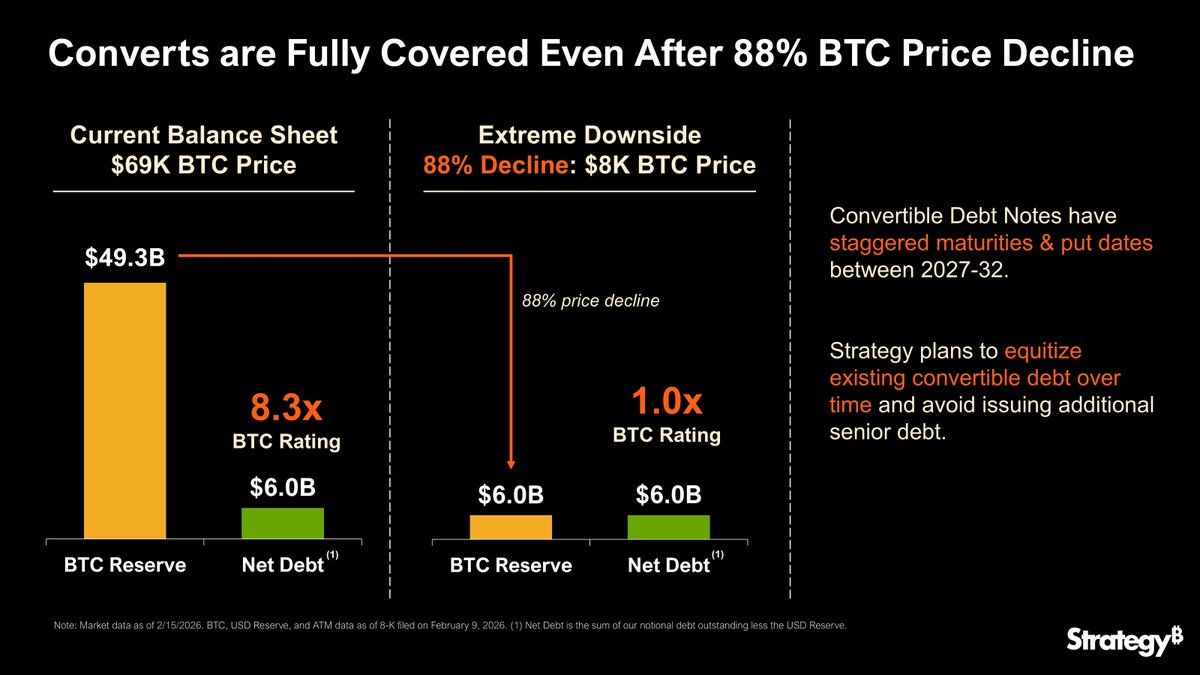

Strategy Can Fully Cover $6 Billion In Debt if Bitcoin Drops 90%, But What Happens Below That Line?

BitGo wins BaFIN nod to offer regulated crypto trading in Europe

BitGo’s move creates further competition in a burgeoning European crypto market that is expected to generate $26 billion revenue this year, according to one estimate. BitGo, a digital asset infrastructure company with more than $100 billion in assets under custody, has received an extension of its license from Germany’s Federal Financial Supervisory Authority (BaFin), enabling it to offer crypto services to European investors. The company said its local subsidiary, BitGo Europe, can now provide custody, staking, transfer, and trading services. Institutional clients will also have access to an over-the-counter (OTC) trading desk and multiple liquidity venues.The extension builds on BitGo’s previous Markets-in-Crypto-Assets (MiCA) license, also issued by BaFIN, and adds trading to the existing custody, transfer and staking services. BitGo acquired its initial MiCA license in May 2025, which allowed it to offer certain services to traditional institutions and crypto native companies in the European Union.Read more