Sreeram Kannan: Building a Trust Layer for Ethereum

Despite the controversy, EigenLayer remains at the core of Ethereum’s evolution.

Written by Thejaswini MA

Compiled by: Block unicorn

Preface

The Caltech interviewer leaned forward and asked an interesting question.

“Suppose I give you unlimited resources, unlimited talent, and 30 years. You lock yourself in a lab like a hermit. After 30 years, you come out and tell me what you invented. What would you create?”

Kanan, then a postdoctoral researcher applying for faculty positions, was stunned. His mind went blank. This problem required unconstrained thinking on a scale he had never attempted before. He had been tackling computational genomics problems for years, building on existing knowledge and making incremental progress. But this problem presented no constraints. No budget constraints. No time pressures. No talent shortages.

There's just one request: What would you build if there were no obstacles?

“I was completely blown away by the scope of the problem,” Kanan recalls. The level of freedom terrified him. He didn’t get the Caltech position. But the problem planted a seed in him that would later grow into one of Ethereum’s most controversial innovations: EigenLayer.

Yet, the journey from a Caltech interview room to running a multi-billion dollar crypto company required Kanan to answer the 30-year-old question in three separate stages, changing his answer with each new phase.

Academic Journey and Transformation

Kannan grew up in Chennai, southern India, where pure mathematics captured his imagination early on. He remained in India to pursue his undergraduate degree at the Guidance College of Engineering, where he participated in the development of ANUSAT, India's first student-designed microsatellite. This project sparked his interest in complex systems and coordination problems.

He arrived in the United States in 2008 with just $40 in funding. He studied telecommunications engineering at the Indian Institute of Science in Bangalore and went on to earn a master's degree in mathematics and a doctorate in electrical and computer engineering from the University of Illinois at Urbana-Champaign.

His doctoral research focused on network information theory, or how information flows through networks of nodes. He spent six years solving long-standing problems in the field. When he finally cracked them, only twenty people in his subfield took notice. No one else paid attention.

The disappointment prompted a moment of reflection. He had been pursuing curiosity and intellectual beauty, not impact. If you don't deliberately pursue it, you can't expect real-world changes to appear as random byproducts.

He drew a two-dimensional graph. The X-axis represented technical depth, and the Y-axis represented impact. His work fell firmly into the high-depth, low-impact quadrant. It was time to move on.

In 2012, he attended a lecture on synthetic genomics by Craig Venter, one of the founders of the Human Genome Project. The field was creating new species, talking about making biological robots rather than mechanical ones. Why waste time optimizing download speeds when you could reprogram life itself?

He transitioned completely to computational genomics, focusing on it during his postdoctoral research at Berkeley and Stanford, where he investigated DNA sequencing algorithms and built mathematical models to understand gene structure.

Then, artificial intelligence caught him off guard. A student proposed using AI to solve the DNA sequencing problem. Kanan rejected the idea. How could his carefully crafted mathematical model be outperformed by a neural network? The student built the model anyway. Two weeks later, the AI crushed Kanan's best benchmark.

The message was: within ten years, AI will replace all his mathematical algorithms. Everything he relied on for his career will be obsolete.

He faced a choice: delve deeper into AI-driven biology or try a new direction. In the end, he chose the new one.

From Buffalo to Earth

The Caltech question had always troubled him. Not because he couldn't answer it, but because he had never thought about it that way before. Most people work incrementally. You have X capabilities, and you try to build X plus incrementally. Making small improvements on what you already have.

The 30-year question requires a completely different kind of thinking. It asks us to imagine a destination without worrying about the path.

After joining the University of Washington as an assistant professor in 2014, Kanan set out on his first 30-year project: decoding how information is stored in living systems. He gathered collaborators and made progress. Everything seemed to be on track.

Then, in 2017, his PhD advisor called and told him about Bitcoin. It had throughput and latency issues—exactly what Kanan had studied during his PhD.

His first reaction? Why would he abandon genomics for "wild guesswork"?

The technological fit was clear, but it seemed far removed from his grand vision. Then he reread Yuval Noah Harari's "Sapiens: A Brief History of Humankind." One idea struck him: What makes humans special isn't our innovation or cleverness, but our ability to coordinate on a massive scale.

Coordination requires trust. The internet connected billions of people, but it left a gap. It allowed us to communicate instantly across continents, but it provided no mechanism to ensure people would keep their promises. Email could transmit promises in milliseconds, but enforcing them still required lawyers, contracts, and centralized institutions.

Blockchains fill this gap. They're not just databases or digital currencies; they're execution engines that transform promises into code. For the first time, strangers can reach binding agreements without relying on banks, governments, or platforms. The code itself holds people accountable.

This became Kanan's new 30-year goal: to build a coordination engine for humanity.

But here, Cannan learned something that many academics often overlook. Having a 30-year vision doesn't mean you can jump straight to 30 years. You have to gain an advantage to solve bigger problems.

Moving the Earth requires a million times more energy than moving a buffalo. If you want to eventually move the Earth, you can't just declare it and hope the resources arrive. According to Kannan, you must first move a buffalo. Then maybe a car. Then a building. Then a city. Each success gives you a bigger chip to take on the next challenge.

The world is designed this way for a reason. Give someone who has never moved a buffalo the power to move the Earth, and the whole world might explode. Incremental leverage prevents catastrophic failure.

Kanan's first attempt at moving buffaloes was Trifecta, a high-throughput blockchain he and two other professors were building. They proposed a blockchain capable of 100,000 transactions per second. But no one funded it.

Why? Because no one needed it. The team optimized the technology without understanding market incentives or identifying the customer. They hired people who thought like them—all PhDs who were solving theoretical problems.

Trifecta failed. Kanan returned to academia and research.

He tried again, creating an NFT marketplace called Arctics. He was previously an advisor to Dapper Labs (which runs NBA Top Shot). The NFT space seemed promising. But as he built the marketplace, he kept running into infrastructure challenges. How could he get reliable price oracles for NFTs? How could he bridge NFTs between different chains? How could he run different execution environments?

This market also failed. He didn’t understand the mindset of NFT traders. If you are not your own customer, you can’t build a meaningful product.

Every problem requires the same thing: a network of trust.

Should he build an oracle? A bridge? Or should he build the metathing that solves all these problems—the trust network itself?

He understood this. He was exactly the kind of person who could build an oracle or a bridge. He could become his own client.

In July 2021, Kanan founded Eigen Labs. The name comes from the German word for "own," meaning that anyone can build whatever they want. Its core philosophy is to enable open innovation through shared security.

The technological innovation is re-staking. Ethereum validators lock up ETH to secure the network. What if they could also use those assets to secure other protocols? Instead of building their own security from scratch, new blockchains or services could leverage Ethereum's established validator set.

Kanan pitched the idea to a16z five times before securing funding. One early pitch was memorable for the wrong reasons. Kanan wanted to build on Cardano because it had an $80 billion market cap but no working smart contracts. An a16z partner answered the phone from outside the Solana conference. Their reaction: "That's interesting. Why did you choose Cardano?"

The feedback forced Kanan to think about focus. Startups are exponential games. You want to transform linear work into exponential impact. If you think you have three exponential ideas, you probably don't have one. You need to choose the one with the highest exponential value and go all in.

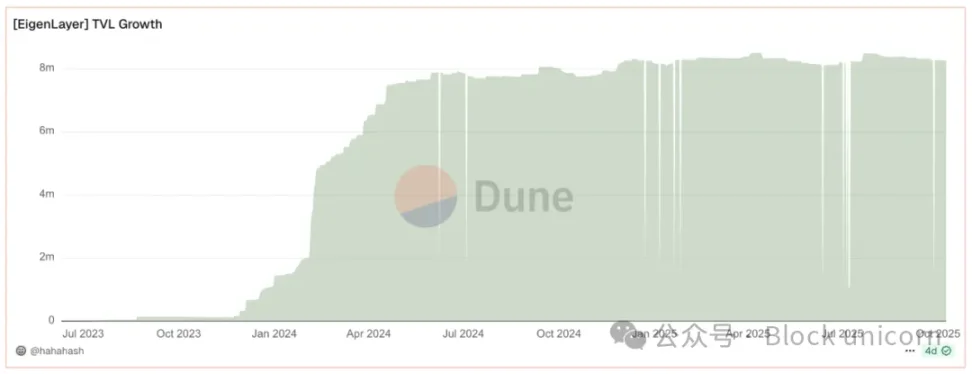

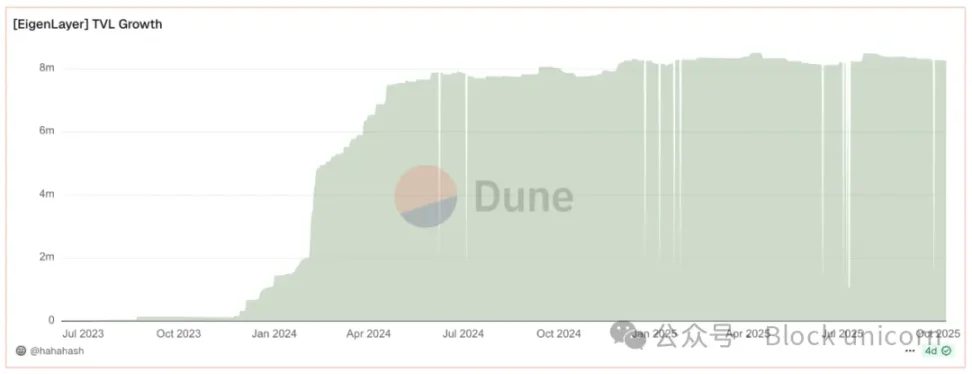

He refocused on Ethereum, a decision that proved to be a good one. By 2023, EigenLayer had raised over $100 million from firms including Andreessen Horowitz. The protocol was rolled out in phases, reaching a total value locked of $20 billion at its peak.

Developers are beginning to build “Active Verification Services” (AVS) on EigenLayer, from data availability layers to AI inference networks, each of which can leverage Ethereum’s security pool without having to build a validator from scratch.

However, with success comes scrutiny. In April 2024, EigenLayer announced its EIGEN token distribution, which sparked a backlash.

The airdrop locked up tokens for months, preventing recipients from selling them. Geographic restrictions excluded users in jurisdictions like the United States, Canada, and China. Many early adopters, who deposited billions of dollars, felt the distribution favored insiders over community members.

The reaction caught Kanan off guard. The protocol's total locked value plummeted by $351 million, and users withdrew their funds in protest. The controversy exposed the gap between Kanan's academic thinking and the expectations of the crypto world.

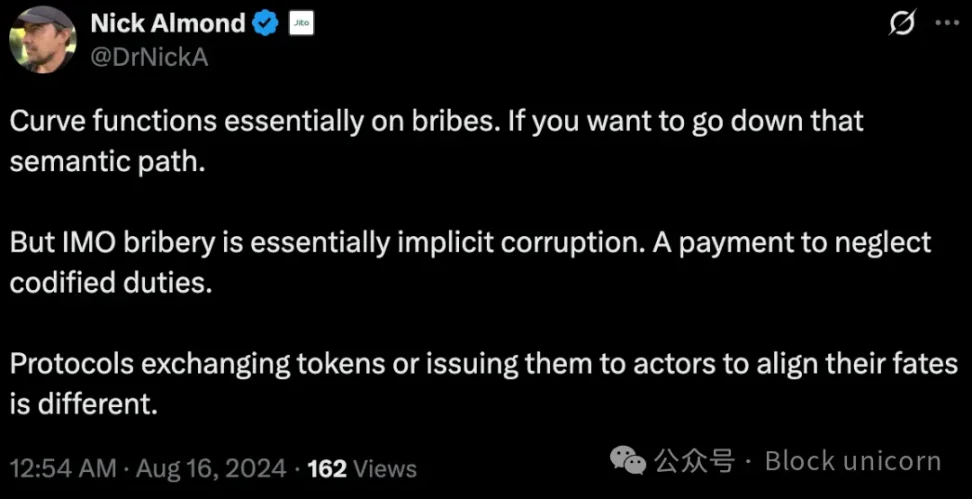

Then came the conflict of interest scandal. In August 2024, CoinDesk reported that Eigen Labs employees received nearly $5 million in airdrops from projects built on EigenLayer. Employees collectively claimed hundreds of thousands of tokens from projects like EtherFi, Renzo, and Altlayer. At least one project, under pressure, included its employees in its distribution.

The revelation sparked accusations that EigenLayer was compromising its “trusted neutrality” stance by using influence to reward projects that offered tokens to employees.

Eigen Labs responded by banning ecosystem projects from airdropping to employees and implementing a lock-up period. But its reputation has been damaged.

Despite these controversies, EigenLayer remains at the heart of Ethereum’s evolution. The protocol has already secured partnerships with major players like Google Cloud and Coinbase, which serves as a node operator.

Kanan’s vision goes far beyond restaking. “Crypto is our coordination superhighway,” he said. “Blockchains are commitment engines. They enable you to make and keep commitments.”

He thinks in terms of quantity, diversity, and verifiability. How many promises can humans make and keep? How diverse can those promises be? And how easily can we verify them?

“This is a crazy, century-long project,” Kanan said. “It’s going to upgrade the human species.”

The protocol launched EigenDA, a data availability system designed to handle the aggregate throughput of all blockchains. The team introduced a subjective governance mechanism to resolve disputes that cannot be verified solely on-chain.

But Kanan admits the work is far from done. “Until you can run education and healthcare on the blockchain, the work is not done. We are far from done.”

His approach combines top-down vision with bottom-up execution. You need to know where the mountain is. But you also need to find the slope leading there from where you stand today.

“If you can’t do anything with your long-term vision today, it’s useless,” he explains.

Verifiable cloud is the next frontier for EigenLayer. Traditional cloud services require trust in Amazon, Google, or Microsoft. Kanan's version lets anyone run cloud services—storage, compute, AI inference—and cryptographically prove they're executing correctly. Validators stake their integrity. Malicious actors lose their stake.

Now in his 40s, Kanan remains an affiliated professor at the University of Washington and runs Eigen Labs. He still publishes research and thinks in terms of information theory and distributed systems.

But he's no longer the academic who couldn't answer Caltech's 30-year-old question. He's now answered it three times—with genomics, with blockchain, and with the Coordination Engine. Each answer builds on the lessons learned from the previous attempt.

The buffalo had been moved. The car had been turned on. The building had begun to move. Whether he could ultimately move the Earth remained to be seen. But Kanan had learned something many scholars never did: the path to solving big problems begins with solving small ones, which build upon the foundations for solving even bigger ones.

This is the story about the founder of EigenLayer.

You May Also Like

Recovery extends to $88.20, momentum improves

Fed Decides On Interest Rates Today—Here’s What To Watch For