NFT sales show minor drop to $65.5M, Ethereum sales plunge 24%

According to CryptoSlam data, NFT sales volume has edged down by 0.47% to $65.58 million, essentially flat from last week’s $67.76 million.

- NFT sales stayed flat at $65.6M, but buyers and sellers jumped over 24%.

- DMarket reclaimed first place as Bitcoin BRC-20 NFTs surged over 300%.

- Bitcoin NFT volume rose sharply while Ethereum and Solana sales declined.

Market participation has continued its strong rebound, with NFT buyers climbing by 26.31% to 292,030 and sellers rising by 24.44% to 205,205. NFT transactions remained nearly unchanged, down just 0.95% to 869,747.

DMarket reclaims top spot with Bitcoin BRC-20 surge

DMarket on the Mythos blockchain has reclaimed first place with $5.32 million in sales, surging 72.49% from last week’s $3.09 million. The collection processed 142,989 transactions with 10,681 buyers and 9,007 sellers.

Courtyard on Polygon (POL) held second position at $4.99 million, up 66.58% from last week’s $2.97 million. The collection recorded 67,082 transactions with 10,039 buyers and 2,192 sellers.

$?? BRC-20 NFTs on Bitcoin (BTC) exploded into third place with $3.45 million, posting a massive 335.14% surge.

The collection saw 2,100 transactions with 822 buyers and 602 sellers, highlighting Bitcoin NFT momentum.

CryptoPunks jumped to fourth with $2.51 million, up 68.62% from last week’s $1.77 million. The Ethereum (ETH) collection had 30 transactions with 25 buyers and 19 sellers.

Milady Maker dropped to fifth at $2.26 million, plummeting 42.01% from last week’s $3.68 million. The collection saw 130 transactions with just 2 buyers and 1 seller.

YES BOND on BNB held sixth place at $2.15 million, posting minimal growth at 0.25% from last week’s $2.12 million. The collection recorded 1,643 transactions.

Bitcoin surges as Ethereum and Solana decline

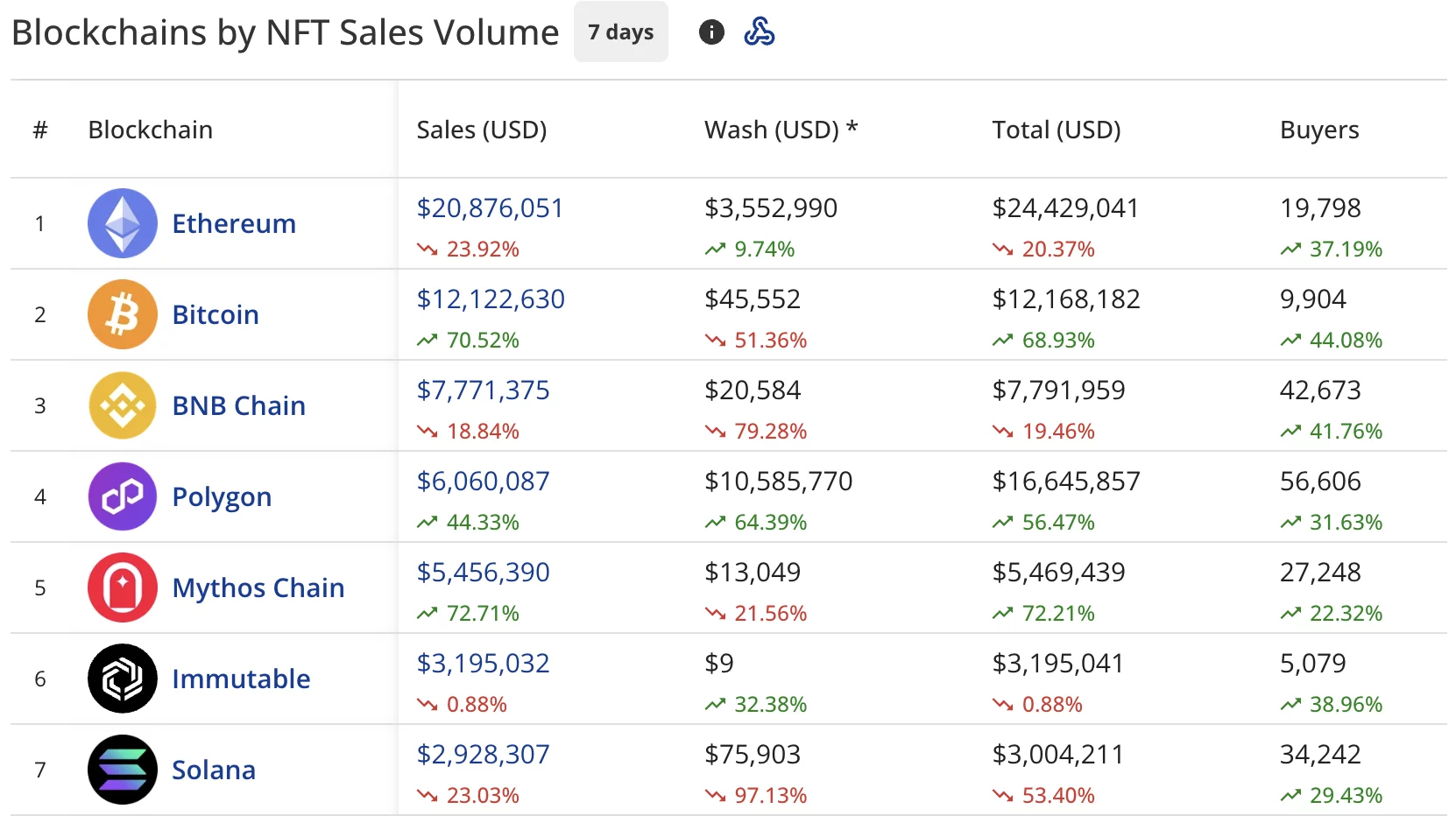

Ethereum maintained first position with $20.88 million in sales, down 23.92% from last week’s $28.06 million.

The network recorded $3.55 million in wash trading, bringing its total to $24.43 million. Buyers climbed 37.19% to 19,798.

Bitcoin surged to second place with $12.12 million, jumping 70.52% from last week’s $7.38 million. The blockchain recorded $45,552 in wash trading, with buyers jumping 44.08% to 9,904.

BNB Chain (BNB) dropped to third at $7.77 million, down 18.84% from last week’s $9.62 million. The blockchain had $20,584 in wash trading, with buyers rising 41.76% to 42,673.

Polygon secured fourth position with $6.06 million, up 44.33% from last week’s $4.12 million.

The blockchain recorded $10.59 million in wash trading, bringing its total to $16.65 million. Buyers increased 31.63% to 56,606.

Mythos Chain climbed to fifth at $5.46 million, surging 72.71% from last week’s $3.22 million. The blockchain attracted 27,248 buyers, up 22.32%.

Immutable (IMX) held sixth position at $3.20 million, essentially flat with a 0.88% decline from last week’s $3.19 million. Buyers jumped 38.96% to 5,079.

Solana (SOL) placed seventh with $2.93 million, down 23.03% from last week’s $3.96 million. The network had 34,242 buyers, up 29.43%.

Bitcoin BRC-20 NFTs dominate top sales

Two $X@AI and $?? BRC-20 NFTs led individual sales:

- $X@AI BRC-20 NFTs topped at $1.92 million (21.7344 BTC), sold four days ago

- $?? BRC-20 NFTs placed second at $1.79 million (20.4401 BTC), sold two days ago

BTC Domain #372a75d6671ec00a1337f33999fb75acf9 sold for $362,729.32 (4.1293 BTC) six days ago.

Two CryptoPunks rounded out the top five:

- CryptoPunks #8408 sold for $118,176.63 (39 ETH) five days ago

- CryptoPunks #8476 sold for $110,904.23 (36.6 ETH) five days ago

You May Also Like

BlackRock boosts AI and US equity exposure in $185 billion models

Putin Claims U.S. Wants to Use Europe’s Largest Nuclear Plant for Bitcoin Mining