Hyper Foundation Confirms Permanent Burn of HYPE Tokens at Assistance Fund Address

- 85% Hyperliquid validators voted in support of the permanent burning of HYPE tokens in the Assistance Fund address.

- HYPE price plunged to $23.93 despite token burn and other major developments on the Hyperliquid network.

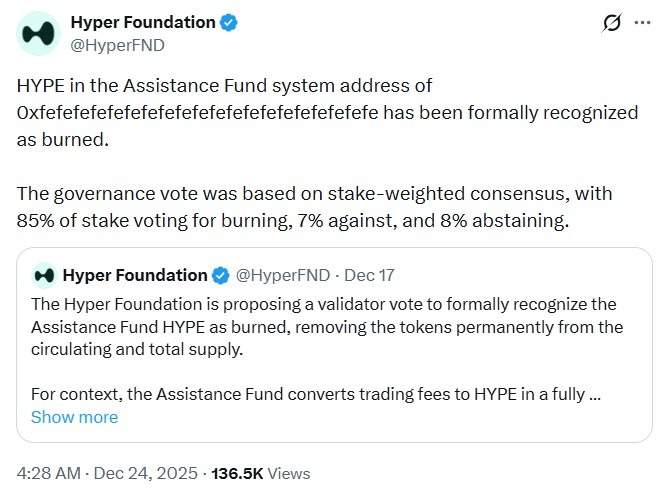

The Hyper Foundation has confirmed the permanent burn of all HYPE tokens in the Assistance Fund Address. This move is backed by an 85% stake-weighted validator positive vote, while 7% voted against and 8% abstained. Hyper Foundation, the organization behind Hyperliquid, a decentralized perpetual futures exchange, confirmed the HYPE token burn on X.

The Assistance Fund is a built-in protocol mechanism in Hyperliquid. It automatically converts a portion of the platform’s trading fees into HYPE tokens. These tokens are transferred to a special system address, 0xfefefefefefefefefefefefefefefefefefefefe.

Hyperliquid Token Burns | Source: Hyper Foundation

Hyperliquid Token Burns | Source: Hyper Foundation

This Assistance Fund address has no private key and is designed to be inaccessible, similar to the zero address. The tokens there are mathematically irretrievable without a major protocol hard fork or upgrade. While the HYPE tokens were technically already out of circulation, they were still counted in the official total circulating supply metrics.

Hence, the Hyper Foundation proposed a governance validator vote on December 17, which ran until December 24, 2025. They designed the proposal as a binding social consensus via governance. Validators’ votes were weighted by the amount of HYPE staked or delegated to them. Accordingly, token holders could delegate their stake to influence the vote outcome. According to the result, 85% validators voted in favor of burning, 7% against, while 8% were absent.

In the future, trading fees routed to the Assistance Fund will also be considered burned. Accordingly, trading fees now act like a continuous buyback-and-burn mechanism. Additionally, the confirmation from Hyper Foundation removes uncertainty about whether the Assistance Fund tokens could return to circulation.

A Strong Hyperliquid Network

The burning of all HYPE tokens on the Assistance Fund address is a major governance win for Hyperliquid. It formalizes a deflationary move that aligns reported token economics with the actual design of the protocol. Additionally, it signals strong community support for long-term scarcity and transparency. Furthermore, it shows that validators can make technical and economic decisions without relying on emergency upgrades.

It also highlights a growing trend in blockchain governance. Networks increasingly rely on social consensus to formalize outcomes that code already enforces. Currently, the HYPE token is down 1.7% over the previous day to trade at $23.93. The daily trading volume also decreased by 14.05% to $179.7 million.

Intriguingly, the HYPE token burn news follows some major developments on the network. For instance, Hyperliquid has introduced a portfolio margin for spot and perps integration. As we discussed earlier, the new feature allows positions to be managed from a single, unified balance.

In a related development, Sonnet BioTherapeutics shareholders approved a merger between Hyperliquid Strategies and Rorschach I LLC. This approval clears the final hurdle in its transition into a digital asset treasury holding HYPE tokens.

]]>You May Also Like

The Best Router to Game and Stream 2025: Game and Stream Fast, Stable, and Lag-Free

Polygon Tops RWA Rankings With $1.1B in Tokenized Assets