Momentum Check: Can Ethena (ENA) Flip Back into Bull Mode?

- Ethena is trading at $0.27 after a 2% spike.

- ENA’s current market sentiment is neutral.

With the sturdy downtrend in the crypto market, all major assets have been charted in red, settling in the bearish zone. The overall market sentiment is extreme fear, as the index value sits at 15. Meanwhile, Bitcoin (BTC) and Ethereum (ETH), the largest assets, are attempting a recovery. Among the altcoins, Ethena (ENA) has modestly spiked by over 2.22%.

In the early hours, the asset traded at a level of $0.274, and after the bearish shift in the ENA market, the price action fell to a low range of $0.2512. If the brief spike gained more traction and initiated an upward move, it would see extended price expansion. At press time, Ethena traded at the $0.2721 zone.

Besides, the market cap of the asset has touched $2.02 billion, with its daily trading volume reaching the $312.56 million mark following a short dip. The Coinglass data has reported that the market has experienced an event of liquidation of $1.13 million worth of Ethena during the last 24 hours.

Can Ethena Hold the Line, or Is a Deeper Dip Loading?

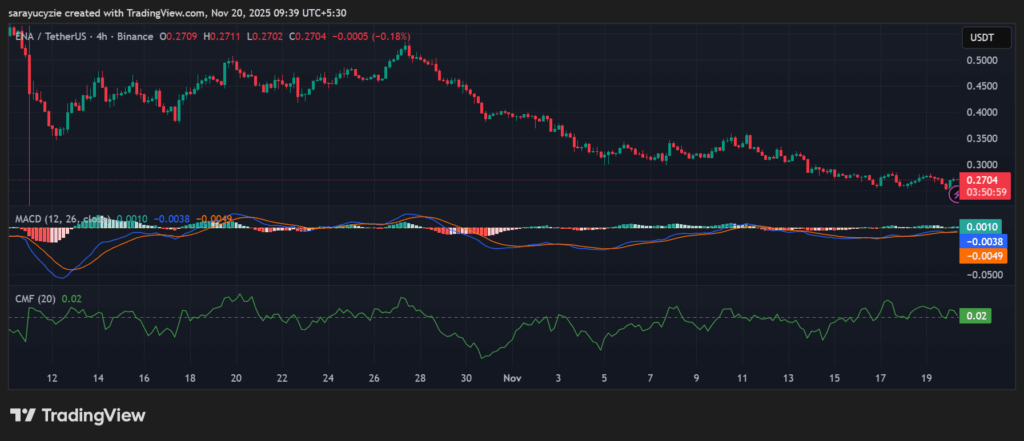

Ethena’s Moving Average Convergence Divergence (MACD) and signal lines are stationed below the zero line, implying the bearish condition. However, if both lines start moving upward, it may be an early sign of a recovery. Moreover, the Chaikin Money Flow (CMF) indicator value of ENA found at 0.02 hints at very mild buying pressure in the market. The money flow is leaning slightly bullish, but the momentum is weak and not a strong confirmation of demand.

ENA chart (Source: TradingView)

ENA chart (Source: TradingView)

The recent trading pattern of Ethena exhibits a negative outlook, with the price falling to test the support at $0.2714. With an intensified downside correction, the bears could initiate the death cross to unfold, and send the price toward the $0.2707 range or even lower.

Conversely, if the ENA bulls showed up, as part of the recovery, the price might move up, and help to find the nearest resistance at $0.2728. Upon the bullish pressure strengthening, the bulls trigger the golden cross to take place, pushing the price above $0.2735.

In addition, the ongoing market sentiment of the ENA is neutral as the daily Relative Strength Index (RSI) is resting at 47.43. There is a slight bearish tilt, but not strongly oversold or overbought, and the price could swing either way. Furthermore, Ethena’s Bull Bear Power (BBP) reading, staying at 0.0025, is very close to zero. The momentum signals no strong bullish or bearish dominance, giving a balanced but indecisive market phase.

Top Updated Crypto News

Dogecoin Bounce Raises Hopes of a Bottom: What’s Next for DOGE Price?

You May Also Like

Waarom Kyrgyzstan via Binance inzet op een stablecoin

Saudi blockchain real estate offers tokenized investment under Vision 2030