Vitalik Buterin Says He’ll Return to Decentralized Social in 2026

Ethereum co-founder Vitalik Buterin has signaled a renewed commitment to decentralized social networks for 2026, arguing that platforms built on shared, open data layers are essential to fostering real competition and mass communication that serves users rather than engagement metrics. In a year marked by broader interest in SocialFi, Buterin has redirected much of his online activity toward decentralized platforms, noting that his 2026 posts have been accessed through Firefly, a cross-client interface that unifies access to X, Lens, Farcaster and Bluesky.

“If we want a better society, we need better mass communication tools,” Buterin said, arguing that decentralization enables competition by allowing multiple clients to operate on a shared social data layer. He criticized many crypto-native social projects for relying on speculative tokens as a substitute for meaningful innovation, arguing that SocialFi experiments have repeatedly failed by rewarding pre-existing social capital and short-term price speculation instead of content quality and constructive discourse. He contrasted these efforts with creator-subscription models such as Substack, which he said better align incentives around high-quality content. Calling for broader community participation, he urged users and builders to spend more time in decentralized social ecosystems, saying the industry must move beyond a single centralized “info warzone” and toward a more competitive frontier where new forms of online interaction can emerge.

The state of decentralized social media

Decentralized social media, or SocialFi, refers to platforms built on open or blockchain-based networks where user identities, content and social graphs are not controlled by a single company. While protocols such as Lens and Farcaster have gained early traction, the sector has so far struggled to translate that momentum into sustained mass-market adoption.

On Wednesday, core infrastructure provider Neynar acquired Farcaster from Merkle. Farcaster co-founder Dan Romero announced the news, saying that “after five years, it’s clear Farcaster needs a new approach and leadership to reach its full potential.”

Lens also underwent a leadership transition this week, as Aave transferred stewardship of the open-source social protocol to Mask Network, tasking the Web3 social company with advancing consumer-ready, on-chain social applications.

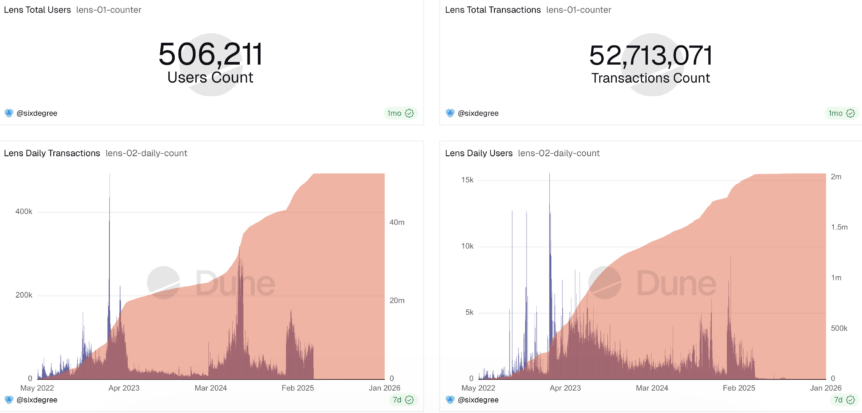

Farcaster features more than two million total registered users and hundreds of thousands of daily interactions, measured by posts and reactions. Lens has accumulated about 506,000 users, according to Dune Analytics data.

Source: Dune Analytics Source: Dune Analytics

Source: Dune Analytics

This article was originally published as Vitalik Buterin Says He’ll Return to Decentralized Social in 2026 on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

Vitalik Buterin Withdraws 16,384 ETH to Fund Open-Source Technology and Privacy Projects

What is the most promising crypto right now? A practical checklist