3 Altcoins That Could Hit All-Time Highs In The Final Week Of November

The crypto market is looking at recovery with Bitcoin reclaiming $85,000 as support. This is pushing the altcoins upwards as well, reigniting hopes of a rally and potential all-time highs.

BeInCrypto has analysed three such altcoins that could hit new all-time highs in the coming days.

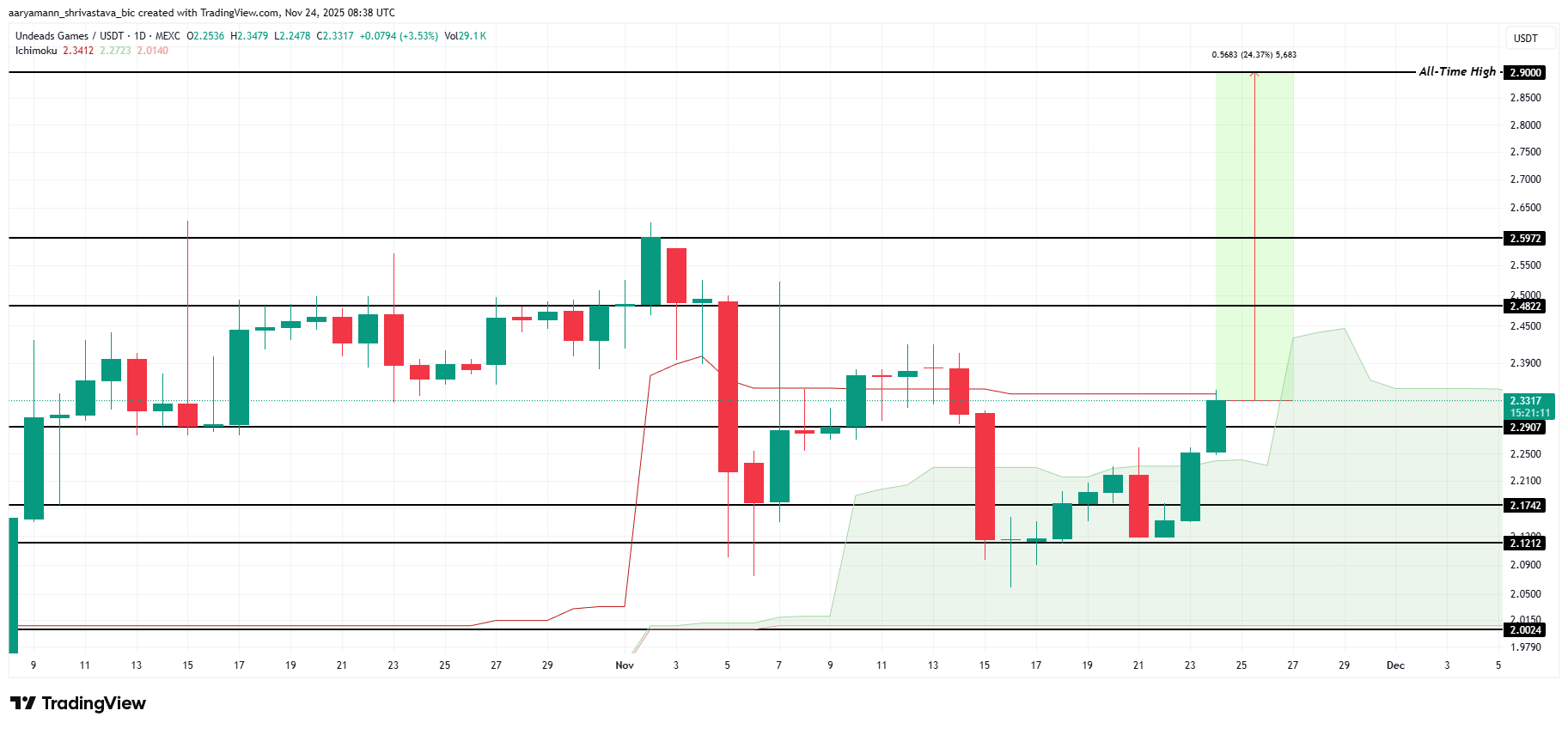

Undead Games (UDS)

UDS has surged 9% in recent days and now trades at $2.33, supported by bullish signals from the Ichimoku Cloud. The indicator highlights strengthening momentum, helping the meme coin maintain upward pressure as investors look for high-volatility opportunities in the current market environment.

UDS is now roughly 24.3% away from its all-time high of $2.90. Reaching this level will require strong investor participation and favorable market conditions. The altcoin must first break through the $2.48 and $2.59 resistance zones, which have historically capped upward movement.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

UDS Price Analysis. Source: TradingView

UDS Price Analysis. Source: TradingView

If momentum fades and investor support weakens, UDS could face a reversal. A fall below the $2.29 support may send the price toward $2.17 or even $2.12. Such a decline would invalidate the bullish thesis and signal a shift toward short-term downside risk.

Kite (KITE)

KITE is trading at $0.098 and sits roughly 35% below its all-time high of $0.133. The altcoin has been climbing steadily for several days, with bulls attempting to establish $0.099 as a firm support level to sustain upward momentum.

The RSI currently signals a bullish outlook as it remains above the neutral 50.0 mark. This positioning suggests continued upside potential as long as KITE avoids entering the overbought zone, where momentum often stalls and short-term corrections emerge.

KITE Price Analysis. Source: TradingView

KITE Price Analysis. Source: TradingView

If market support weakens, KITE may struggle to maintain its gains. A drop toward the $0.089 support could follow, and losing that level may send the price to $0.079. Such a decline would invalidate the bullish thesis and signal renewed downside risk.

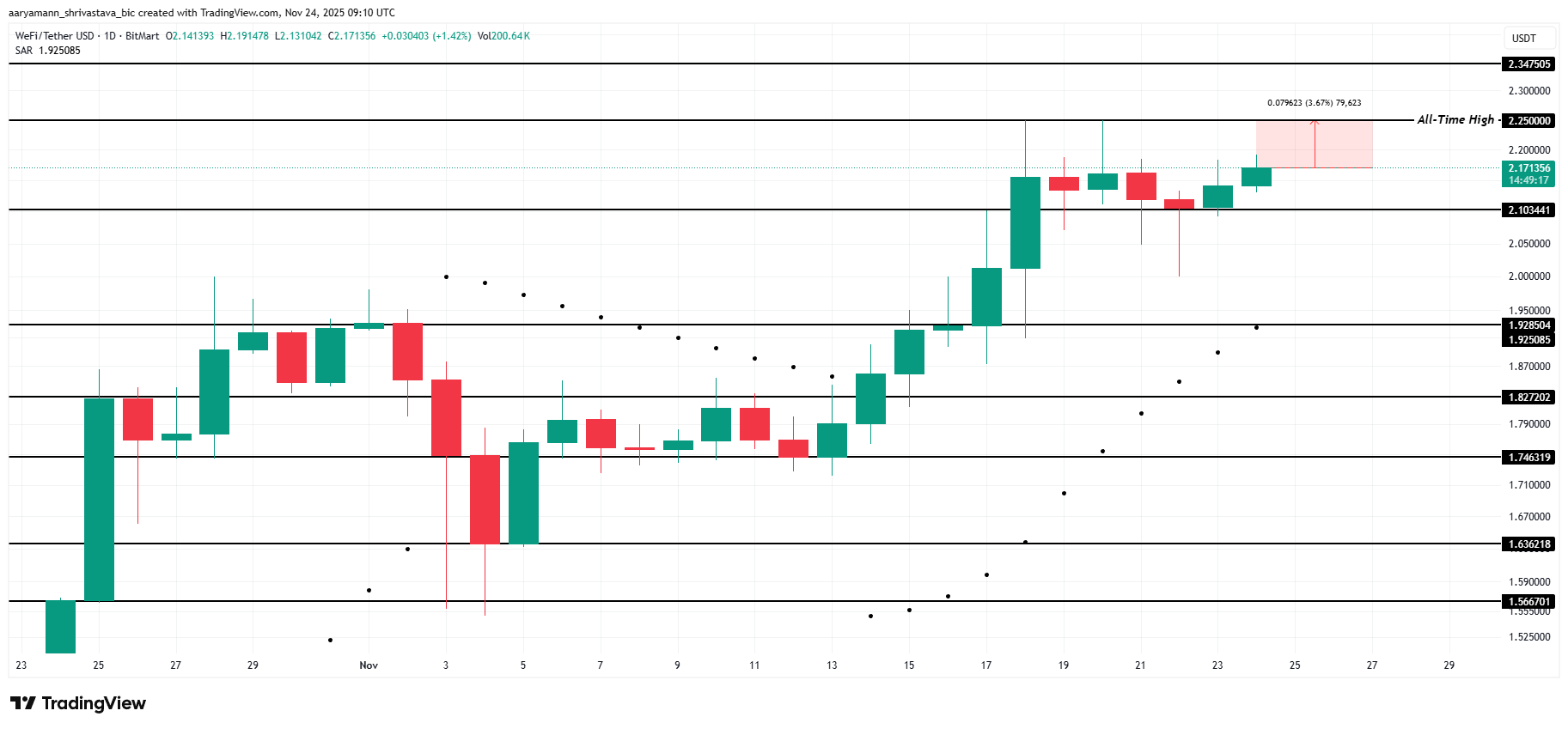

Wefi (WFI)

WFI is trading at $2.17 and sits just below the $2.25 level, which also marks its all-time high reached last week. The altcoin remains in a tight range as traders watch for signs of renewed momentum capable of driving a decisive breakout.

WFI recently bounced off the $2.10 support level and is now less than 3.7% away from retesting its ATH. The Parabolic SAR shows a clear uptrend, signaling that bullish pressure is building. If this momentum holds, WFI could push past $2.25 and set a new high.

WFI Price Analysis. Source: TradingView

WFI Price Analysis. Source: TradingView

If bullish momentum weakens, WFI may repeat previous patterns by touching the ATH and falling again. A rejection at this level could pull the price below $2.10 and potentially toward $2.00 or even $1.92. Such a move would invalidate the bullish thesis and expose WFI to a deeper correction.

You May Also Like

Bitcoin ETFs Surge with 20,685 BTC Inflows, Marking Strongest Week

XAG/USD retreats toward $113.00 on profit-taking pressure