Target Corp. ($TGT) Stock: Shares Fall Below $100 on Q2 Earnings, CEO Transition

TLDR

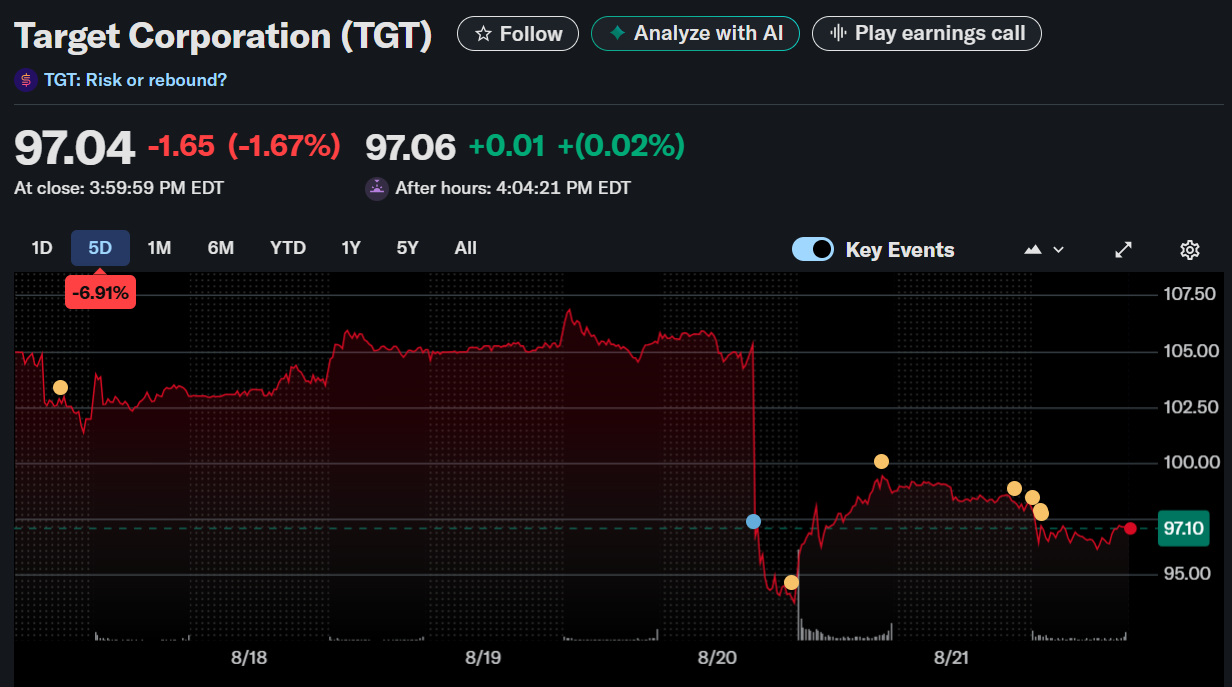

- Target shares dip to $96.65 as of Aug. 21, 2025, reflecting investor concerns after Q2 earnings.

- Comparable sales declined 1.9%, though results showed slight improvement from Q1.

- Digital sales rose 4.3%, with Target Circle 360 same-day delivery up more than 25%.

- CEO Brian Cornell steps down, with Michael Fiddelke set to lead the retailer forward.

- Net income dropped 21.5% YoY to $935 million, while EPS fell to $2.05 from $2.57.

On August 21, 2025, Target Corporation (NYSE: TGT) reported Q2 results that sent its stock down 2.07% to $96.65 in midday trading.

Target Corporation (TGT)

At the close of the previous session, shares had already slipped to $98.69, pushing the company below the symbolic $100 mark. Investors reacted negatively to weaker sales, margin pressure, and the announcement of a CEO transition.

Q2 2025 Performance Highlights

Target posted net sales of $25.2 billion, down 0.9% year-over-year, while comparable sales dropped 1.9%. This was a nearly two-point improvement compared to Q1, but still marked the ninth decline in comps out of the last eleven quarters.

Digital channels provided a bright spot, rising 4.3%, driven by same-day delivery through Target Circle 360, which surged more than 25%. Categories like “Fun 101,” covering toys, entertainment, and impulse buys, grew more than 5%, while trading card sales climbed nearly 70% year-to-date, positioning the segment to surpass $1 billion in sales this year.

Profitability and Margins Under Pressure

The retailer’s gross margin rate contracted by one percentage point from last year, weighed down by inventory adjustment costs and tariffs. Net income fell 21.5% to $935 million, compared with $1.19 billion in Q2 2024. Both GAAP and adjusted EPS came in at $2.05, down from $2.57 a year earlier.

While Target kept SG&A expenses 0.1% lower year-over-year through strict cost controls, profitability remains under stress as consumer caution and higher tariffs cut into earnings.

Leadership Transition: Cornell to Fiddelke

The most significant corporate update came with CEO Brian Cornell announcing his departure. Michael Fiddelke, the current CFO, will take over as CEO and board chair. While Cornell was credited with steering Target through growth phases and digital transformation, analysts expressed concerns that an internal hire may not break from entrenched strategies.

Fiddelke outlined his priorities: revitalizing Target’s merchandising authority, improving in-store customer experiences, and accelerating technology investments. He acknowledged the company’s missteps, noting overemphasis on basic goods during the pandemic and supply chain struggles that left store experiences inconsistent.

Outlook and Market Challenges

Target reaffirmed its outlook for fiscal 2025, expecting GAAP EPS between $8 and $10 and adjusted EPS in the $7 to $9 range, alongside a low single-digit decline in sales. Capital expenditures remain on track to reach $4 billion for the year, with $1.9 billion already invested.

Still, the retailer faces a difficult path forward. From margin pressures to consumer boycotts and competition from Walmart and off-price chains, Target’s challenges remain steep. Analysts argue the company must rediscover its balance of style and affordability that once made it stand out in U.S. retail.

The post Target Corp. ($TGT) Stock: Shares Fall Below $100 on Q2 Earnings, CEO Transition appeared first on CoinCentral.

You May Also Like

Robert W. Baird & Co. Discloses Core AI Design Parameters and Launches Public Testing of Baird NEUROFORGE™ Equity AI

Best Crypto to Buy as Saylor & Crypto Execs Meet in US Treasury Council