Canton Network Strengthens Institutional Stack as CC Price Strongly Reacts to Fireblocks Integration

The post Canton Network Strengthens Institutional Stack as CC Price Strongly Reacts to Fireblocks Integration appeared first on Coinpedia Fintech News

Canton network price today is trading near $0.189 as fresh institutional infrastructure developments reshape its market context. The catalyst comes from Fireblocks’ integration with the Canton Network, a move that strengthens regulated settlement access while drawing attention to CC/USD at a critical technical juncture.

Fireblocks Integration Alters Canton’s Institutional Narrative

Meanwhile, Fireblocks, which is known and trusted by more than 2,400 enterprises and securing over $5 trillion in annual digital asset transfers has announced a new integration with the Canton Network. The move expands Fireblocks’ regulated infrastructure offerings for tokenization, settlement, and institutional digital asset flows.

At the same time, the integration introduces custody and operational support for Canton Coin (CC) directly within Fireblocks’ platform. This gives financial institutions a governed and privacy-enabled environment to begin settling assets on Canton using Fireblocks’ enterprise-grade policy controls and workflow automation.

Interest from traditional financial institutions has already been accelerating Canton’s momentum. The network is increasingly being viewed as a preferred infrastructure layer for regulated tokenization, including tokenized securities, deposits, and settlement workflows. That shift places Canton network crypto closer to institutional deployment rather than speculative experimentation.

Regulated Custody Strengthens Market Confidence

That said, custody for Canton Coin will be provided through Fireblocks Trust Company, a qualified custodian chartered by the New York State Department of Financial Services (NYDFS). This structure provides a regulatory-compliant custody framework designed to meet fiduciary and risk management standards expected by large financial firms.

Still, the update also leverages Fireblocks’ MPC security architecture and governance controls. Institutions operating on Canton now gain protections suited for institutional-scale adoption, including key management safeguards and operational oversight. These features are increasingly seen as prerequisites for regulated digital finance participation.

From a market perspective, such developments often influence how participants assess network credibility, even when broader crypto conditions remain uncertain.

Canton Network Price Chart Shows Improving Structure

From a technical perspective, the Canton network price chart suggests that CC/USD has been trending upward from a key support zone. On the daily timeframe, $0.177 has established itself as immediate support after the price flipped the $0.160 level.

Price structure aligns with both an ascending parallel wedge and a developing cup-and-handle formation. The current rally remains contained within the ascending channel, suggesting controlled momentum rather than volatility-driven expansion.

If price continues to respect this structure, the upper boundary of the wedge near $0.220 becomes a level of interest. That zone may act as resistance and could invite a pullback toward the lower channel boundary near $0.140, which would still preserve a constructive longer-term setup. However, a sustained move beyond $0.220 would open the possibility of a broader reassessment in the Canton network price forecast.

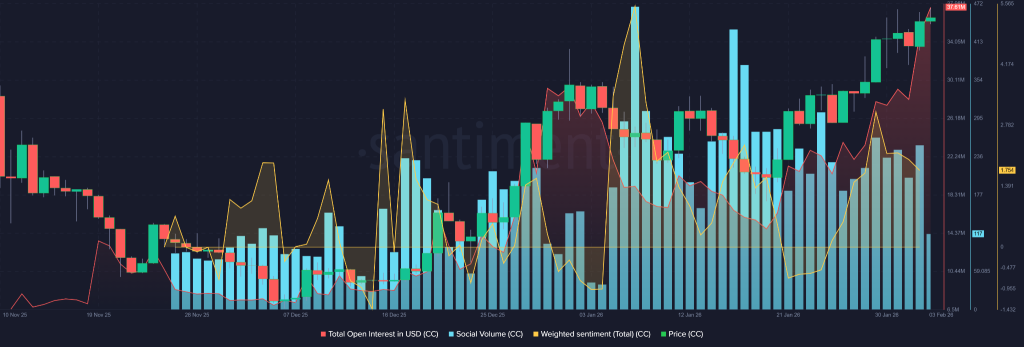

Derivatives and Sentiment Data Add Context

Additionally, derivatives data shows total open interest for CC/USD reaching an all-time high of $37.61 million. This indicates increasing participation, even as price action remains technically structured.

Social volume has also been building into Q1 2026, pointing to rising discussion around Canton network crypto. Weighted sentiment metrics suggest that commentary has skewed more positive than negative, reinforcing engagement without signaling speculative crowd behavior.

Taken together, these metrics suggest that the Canton network price is increasingly reflecting infrastructure-driven interest rather than short-term momentum trading, and that the price may tilt on the higher side for a longer span.

You May Also Like

Cathie Wood's Ark Bets Big On Solana Treasury Play: Makes $162M Investment In Brera Holdings As Stock Explodes 225%

A Reality Check Pi Holders Might Not Want to Hear