Ethereum (ETH) Slumps Below $2,400 to 7-Month Low Amid Market-Wide Crash

Saturday has brought another market-wide crash in the cryptocurrency space, and Ethereum is among the poorest performers over the past day (and week).

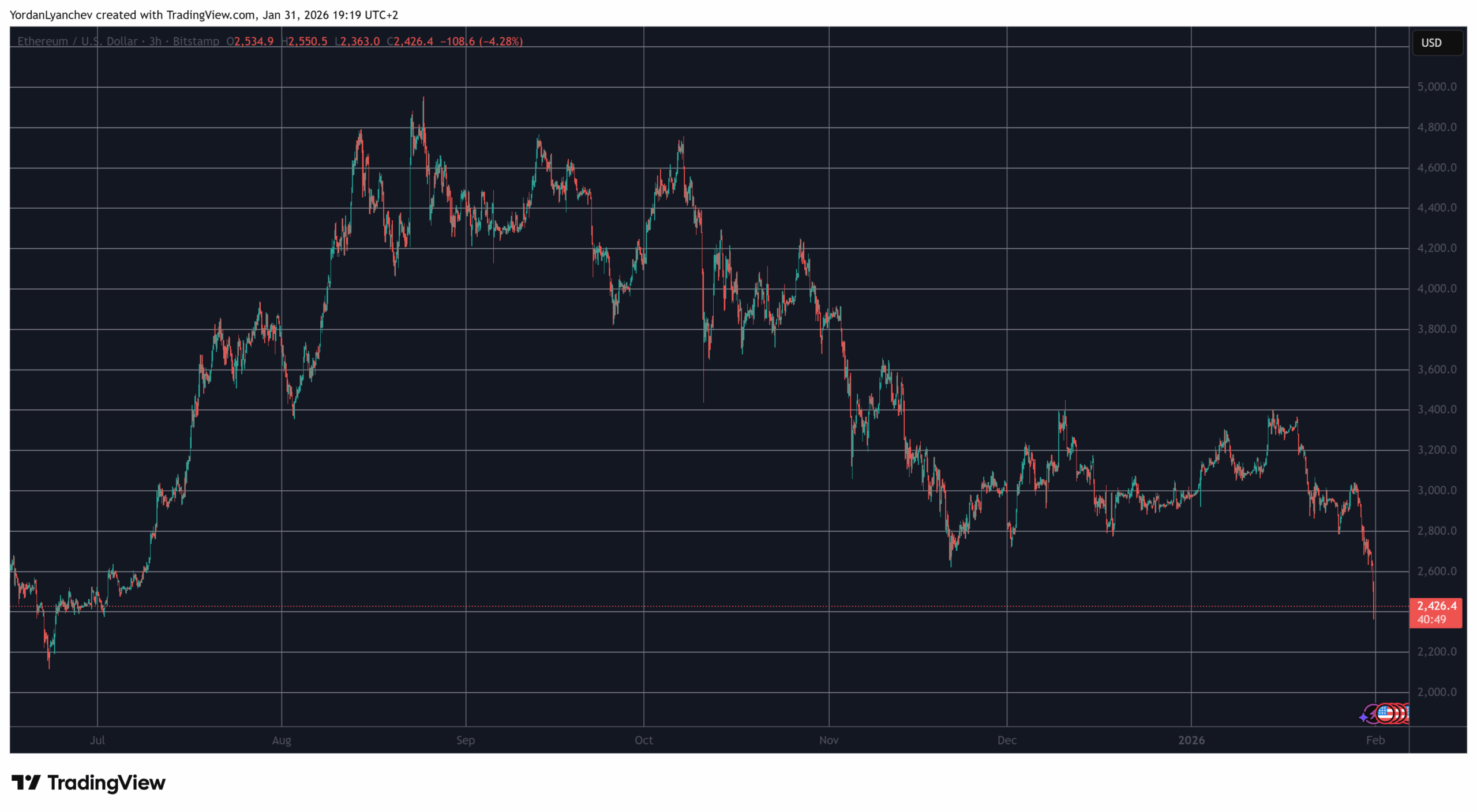

In the past few hours alone, the largest altcoin slumped below $2,400 for the first time since July 2. This means that the asset has plummeted by over 10% in the past day, and it’s down by a whopping 18% weekly.

ETHUSD Jan 31. Source: TradingView

ETHUSD Jan 31. Source: TradingView

Recall that ETH had reclaimed the psychological $3,000 level on Wednesday when it tapped $3,070 for the first time in several days. This came before the first FOMC meeting for the year, but the asset began its spectacular nosedive in the following hours after the Fed paused the interest rate cuts.

The skyrocketing geopolitical tension in the Middle East led to another crash on Thursday when ETH, alongside the rest of the crypto market, tumbled below $2,800. Friday was less eventful in the crypto world, unlike the precious metal market, but the risk-on asset class that trades 24/7 is suffering now once again.

Ali Martinez informed that Ethereum investors have been sending tokens en masse to trading platforms, with more than 70,000 ETH reaching exchanges in the past three days alone.

Merlijn The Trader noted that ETH has dropped below a crucial support at $2,700, which puts it in a “make-it-or-break-it” situation.

On a more positive note, another analyst, CW, claimed that Ethereum whales have been net buying the asset a lot more than BTC for the past day.

Ethereum’s crash, which is the worst among the larger-cap cryptocurrencies, has harmed over-leveraged traders. CoinGlass data show that over $550 million in ETH longs have been liquidated in the past 24 hours, more than the BTC wipeouts ($475 million).

The post Ethereum (ETH) Slumps Below $2,400 to 7-Month Low Amid Market-Wide Crash appeared first on CryptoPotato.

You May Also Like

The author of "Rich Dad Poor Dad": Prepare to buy during the gold, silver, and Bitcoin market crash.

House Judiciary Rejects Vote To Subpoena Banks CEOs For Epstein Case