Property and Casualty Insurance Statistics 2026: Shocking Trends You Must See Now

Imagine the moment after a devastating storm or fire: homes damaged, lives disrupted, and communities in turmoil. The property and casualty insurance industry steps in as a safety net, helping individuals and businesses recover from unforeseen events. Today, this industry continues to evolve, adapting to climate change, regulatory updates, and technological advancements that are reshaping its landscape. In this article, we will dive deep into the key statistics and market trends driving the property and casualty (P&C) insurance sector, offering you valuable insights for the year ahead.

Editor’s Choice

- The global P&C insurance market is projected to reach $4.66 trillion in 2026, supported by rising risk awareness and economic growth.

- Global insured losses from natural catastrophes remained elevated at $127 billion in 2025, marking the sixth consecutive year above the $100 billion threshold and signaling continued pressure into 2026.

- Secondary perils such as severe convective storms generated $61 billion in insured losses in 2025, underscoring ongoing climate-driven volatility for 2026 underwriting.

- Real (inflation-adjusted) non-life insurance premiums are forecast to grow by about 3% annually over 2025–2026, more than twice the historical average.

- The global cyber insurance market is projected to grow at a 17.88% CAGR from 2026 to 2034, reaching about $73.5 billion by 2034.

- The global cyber insurance market was worth about $20.56 billion in 2025, reflecting rapid expansion ahead of further growth in 2026.

- The global property and casualty insurance market is projected to expand at around 8.24% CAGR from 2026 to 2035, reaching roughly $9.49 trillion by 2035.

Recent Developments

- Data privacy non-compliance costs insurers an average of $14.82 million, nearly three times compliance expenses amid surging regulations.

- U.S. House GOP budget proposes clean energy tax credits phaseout after 2028, dropping to 40% in 2031.

- Solvency II 2026 review reinforces capital requirements, prompting portfolio adjustments for European insurers.

- NAIC Model Law mandates cybersecurity programs; 2026 global cyber claims average $115,000-$264,000 per incident.

- 28% U.S. insurers disclose across all TCFD pillars for climate risks; scenario analysis uses.

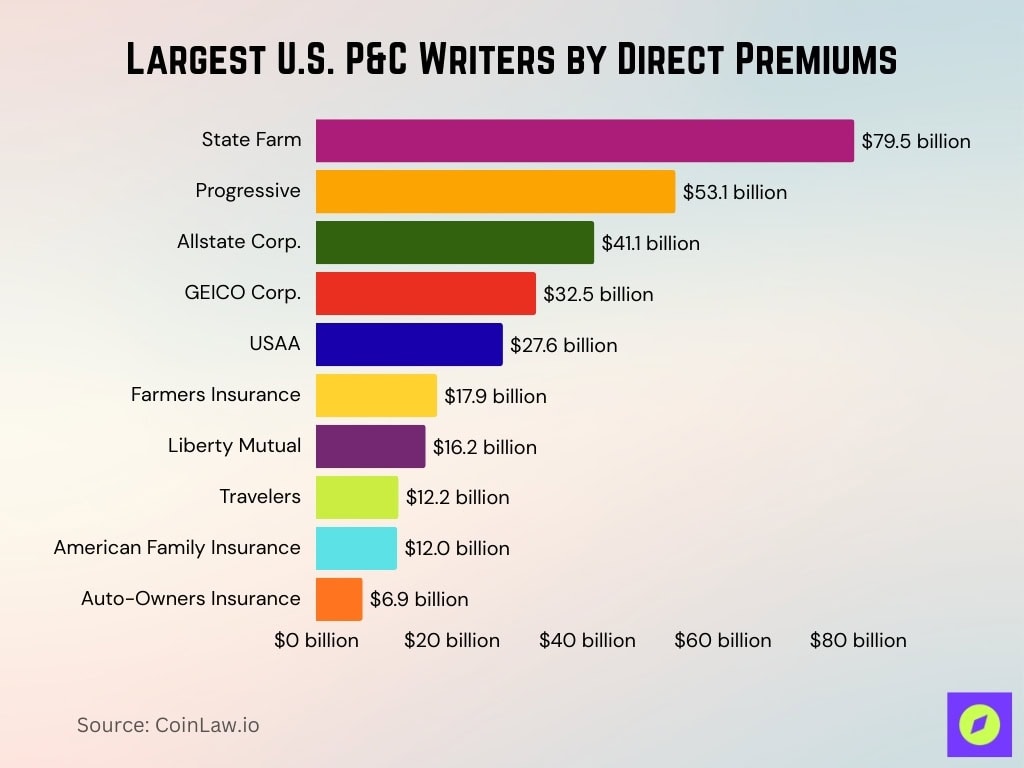

Largest US Property & Casualty Writers

- State Farm dominates the U.S. P&C market, writing $79.5 billion in direct personal lines premiums, reinforcing its position as the clear industry leader.

- Progressive ranks second with $53.1 billion in premiums, highlighting its strong scale in auto and personal insurance products.

- Allstate Corp. holds third place, generating $41.1 billion in direct premiums, supported by its diversified personal lines portfolio.

- GEICO Corp. remains a top-five carrier, reporting $32.5 billion in premiums and maintaining a significant share of the U.S. auto insurance market.

- USAA continues to serve a large niche audience, writing $27.6 billion in direct premiums focused on military members and their families.

- Farmers Insurance crosses the $17 billion mark, with $17.9 billion in premiums, reflecting steady personal lines demand.

- Liberty Mutual reports $16.2 billion in direct premiums, placing it among the largest national P&C writers despite recent market pressures.

- Travelers records $12.2 billion in personal lines premiums, maintaining a solid presence alongside its commercial insurance strength.

- American Family Insurance generates $12.0 billion in direct premiums, underscoring its regional strength and expanding national footprint.

- Auto-Owners Insurance rounds out the top ten, writing $6.9 billion in premiums and showing notable scale among mutual insurers.

(Reference: S&P Global)

(Reference: S&P Global)

Spotlight on Florida’s Hurricanes and California’s Wildfires

- Florida hurricane insurance premiums rose 12% average in 2025.

- California homeowners face 17% premium hike from June 2025.

- $20 billion insured losses from the January 2025 California wildfires.

- California FAIR Plan exposure reaches $5 billion in wildfire zones.

- Florida P&C premiums average $6,000 annually, the highest nationally.

- 95% California zip codes saw premium increases in 2025.

- FAIR Plan policies grew 25% year-over-year to 1.4 million.

- Florida catastrophe fund assesses $2 billion post-hurricane.

Property and Casualty Insurance Market Segmentation Breakdown

- Homeowners insurance holds the largest 38% market share by product type.

- Vehicle insurance commands 42.87% share by product in 2026.

- Individuals represent 56.31% end-user market share in 2026.

- Indirect channels (agents, brokers) hold 56.68% distribution share.

- Personal lines comprise 50% of total P&C premiums written.

- Commercial lines account for over 38% of premiums.

Industry Growth Drivers

- Homeowners’ insurance premiums rose 21% nationwide in 2025 due to climate disasters.

- US P&C direct premiums written expected to grow 5% in 2025-2026.

- AI improves underwriting loss ratio predictions by up to 15% over traditional methods.

- 47% insurance policy purchases occur through digital channels.

- 69% US households own at least one smart home device, driving personalized policies.

- Machine learning boosts underwriting accuracy by 54% for risk assessments.

- 60% P&C insurers are piloting or deploying AI technologies.

- Premiums increased in 95% US zip codes, 33% facing hikes of over 30%.

Reinsurance Pricing Expectations for Renewals

- 30% respondents expect prices rising >5% at 2026 renewals.

- 26% anticipate moderate <5% premium increases.

- 22% forecast stable pricing with no changes.

- 12% predict mild <5% price decreases.

- 10% expect significant >5% price drops.

- 65% reinsurers report hardening market conditions.

- Global reinsurance capital reaches $715 billion, supporting capacity.

National Flood Insurance Program

- NFIP covers 4.7 million policyholders with $1.3 trillion coverage.

- Average annual NFIP premium stands at $899 under Risk Rating 2.0.

- Premium increases are capped at 18% annually for most policies.

- NFIP claims total exceeds $70 billion since 1968.

- 22,000+ communities participate in the NFIP program nationwide.

- NFIP debt reaches $22.525 billion after a $2 billion 2025 increase.

- Private flood insurance writes $0.5 billion in residential premiums.

- Flood claims from non-high-risk zones rise 15% annually.

- Reauthorization deadline set for September 30, 2025.

Impact of Climate and Catastrophic Events

- Severe convective storms generate $61 billion in insured losses.

- LA wildfires cause $28-$35 billion in property insured losses.

- Munich Re estimates $108 billion insured losses from nat cats.

- Total economic losses from natural disasters reach $224 billion.

- Europe’s natural disaster losses hit $11 billion, half insured.

- Tornadoes contribute to $50 billion in severe storm insured losses.

- Hurricane Melissa inflicts $2.5 billion in insured losses.

- Global insured nat cat losses total $129 billion in 2025.

- US accounts for 78% of worldwide insured losses at $103 billion.

Regional Insights

- US P&C premiums grow 7.2% in 2026, reaching a $1.14 trillion market size.

- California home insurance premiums projected to rise 20%+ through 2025 end.

- Canada EI premium rate set at $1.63 per $100 insurable earnings, maximum $68,900.

- US P&C growth outpaces GDP at 2.6% versus 2.0% in 2026.

- UK car insurance averages £550-£607 annually, down 10-18% from 2024.

- Asia-Pacific P&C insurers maintain strong earnings momentum into 2026.

- California’s large carriers request 30%+ rate hikes due to wildfire losses.

- Germany P&C investment returns achieve 2.9% performance.

Frequently Asked Questions (FAQs)

Industry sources expect U.S. P&C premium growth to slow from about 5.5% in 2025 to roughly 3% in 2026.

The U.S. P&C insurance market is estimated at $1.14 trillion in 2026.

U.S. P&C premium growth is projected to moderate to about 3% in 2026.

Conclusion

As the property and casualty insurance industry faces an increasingly complex landscape, the influence of technology, regulation, and climate change cannot be overstated. From rising premiums driven by natural disasters to the rapid integration of AI and blockchain, the sector is evolving quickly. Insurers must continue to innovate, adjust to regulatory changes, and develop new solutions to manage emerging risks. With the growing demand for cyber insurance, the need for better climate risk assessment, and the rise of digital transformation, the P&C industry will remain crucial to safeguarding homes, businesses, and livelihoods in an unpredictable world.

The post Property and Casualty Insurance Statistics 2026: Shocking Trends You Must See Now appeared first on CoinLaw.

You May Also Like

XRP Insider Shuts Down Whale Drama: Big Holders Won’t Control Crypto’s Long-Term Price

Nearly 150 Million Pi Migrated in Just Two Days, What This Unprecedented Move Means for Pi Network’s Future