BitMine Doubles Down on Ethereum With $40M Accumulation

Ethereum is currently trading above the $3,000 level, offering a surface-level sense of stability after weeks of volatility. However, beneath this price resilience, market sentiment remains decisively bearish. Many analysts are openly calling for lower levels in the coming months, citing weakening momentum, macro uncertainty, and persistent selling pressure across risk assets. Extreme fear dominates positioning, with investors showing little conviction that the recent recovery can evolve into a sustained uptrend.

This pessimistic backdrop makes recent institutional-linked activity stand out. Amid widespread caution, data suggests that Bitmine—an entity associated with Fundstrat’s co-founder Tom Lee—has increased its exposure to Ethereum.

Bitmine is a digital asset mining and investment vehicle focused on long-term participation in blockchain infrastructure, combining mining operations with strategic accumulation of major crypto assets. Rather than trading short-term price swings, entities like Bitmine typically operate with a multi-year horizon, emphasizing network fundamentals and asymmetric upside.

The contrast is notable. While retail and short-term participants remain defensive, longer-term capital appears willing to step in during periods of fear. Historically, such divergence between sentiment and positioning has often emerged near transitional phases in the market cycle.

Bitmine Expands Ethereum Exposure Amid Market Fear

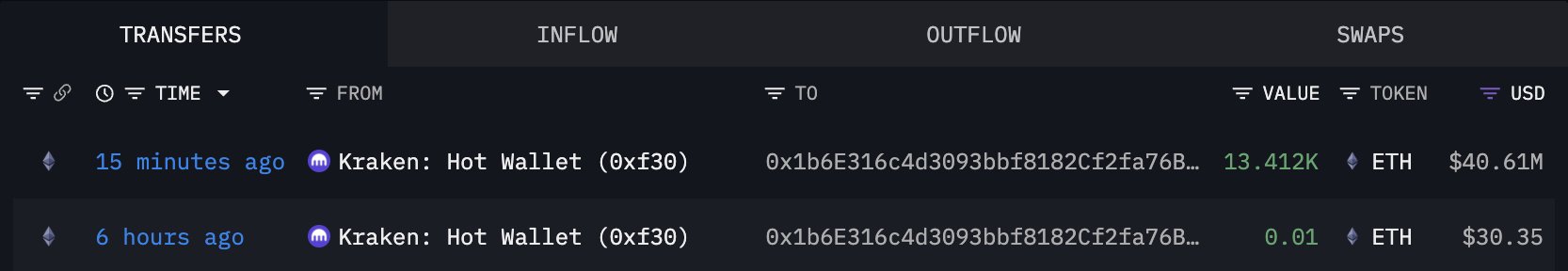

On-chain data from Arkham confirms that Bitmine has added another 13,412 ETH to its holdings, an acquisition valued at approximately $40.61 million at current market prices. The purchase comes at a time when Ethereum sentiment remains deeply bearish, reinforcing the contrast between short-term market fear and long-term capital positioning.

Following this latest accumulation, Bitmine’s total Ethereum holdings now stand at roughly 3.769 million ETH, with an estimated market value of around $11.45 billion. This places Bitmine among the largest known Ethereum holders globally, highlighting the scale and conviction behind its strategy.

Such positioning is not consistent with short-term speculation. Instead, it reflects a deliberate approach centered on long-duration exposure to Ethereum’s network value and future role within the digital asset ecosystem.

Bitmine’s accumulation behavior suggests confidence in Ethereum’s long-term fundamentals despite near-term volatility and widespread pessimism. Historically, large-scale purchases during periods of extreme fear have often occurred when prices trade below perceived intrinsic value.

While this activity does not eliminate the risk of further downside in the coming months, it signals that structurally patient capital continues to deploy. The growing divergence between bearish sentiment and aggressive accumulation underscores a market environment where positioning, rather than headlines, may offer clearer insight into longer-term expectations.

Some investors are using current pessimism as an opportunity to build exposure, reinforcing the idea that fear-driven environments can also attract structurally patient buyers.

Ethereum Price Struggles to Rebuild Bullish Structure

Ethereum is currently trading just above the $3,000 level, attempting to stabilize after a prolonged corrective phase. The chart shows that ETH remains below its key medium-term moving averages, with the 50-day and 100-day MAs still acting as dynamic resistance overhead. Each recent attempt to push higher has been met with selling pressure, highlighting the market’s difficulty in reclaiming bullish momentum.

Structurally, the price action since the October peak reflects a clear sequence of lower highs and lower lows, confirming that ETH is still operating within a bearish trend on the daily timeframe. Although the recent bounce from the $2,800–$2,900 zone suggests the presence of demand, volume remains muted compared to earlier expansion phases, indicating a lack of conviction from buyers. This supports the view that the current move is corrective rather than the start of a new impulsive rally.

From a support perspective, the $2,900 area is now critical. A sustained loss of this level would expose ETH to a deeper retracement toward the $2,600–$2,700 region, where prior consolidation occurred. On the upside, bulls would need a decisive daily close above the descending moving averages near $3,300 to invalidate the bearish structure.

Overall, the chart points to consolidation under resistance rather than trend reversal. Until ETH reclaims key moving averages with expanding volume, price action suggests ongoing distribution and elevated risk of further downside.

Featured image from ChatGPT, chart from TradingView.com

You May Also Like

Wall Street Bets on XRP: Adoption-Driven Peak by 2026

How to earn from cloud mining: IeByte’s upgraded auto-cloud mining platform unlocks genuine passive earnings