Bitcoin-treasury Strategy Boosts Cash Reserve to $2.19 Billion, Pauses BTC Buying

Bitcoin Magazine

Bitcoin-treasury Strategy Boosts Cash Reserve to $2.19 Billion, Pauses BTC Buying

Billionaire Bitcoin advocate Michael Saylor’s company, Strategy Inc., increased its U.S. dollar reserves by $748 million last week, lifting total cash liquidity to $2.19 billion, according to a regulatory filing released today.

The update confirms that the company continues to hold 671,268 bitcoin, leaving its total BTC position unchanged during the reporting period from Dec. 15 to Dec. 21.

Strategy remains the largest corporate holder of bitcoin, with an aggregate purchase price of roughly $50.33 billion.The increase in cash stems from sales conducted under the company’s at-the-market equity offering program.

During the week, the company sold roughly 4.54 million shares of its Class A common stock, generating $747.8 million in net proceeds after commissions. No preferred stock was issued, despite multiple preferred share classes remaining available for sale.

As of Dec. 21, Strategy reported more than $41 billion in remaining capacity across its common and preferred stock ATM programs.

The filing shows that the company did not purchase any bitcoin during the period. Its holdings remained steady at 671,268 BTC, acquired at an average price of $74,972 per coin, inclusive of fees and expenses. The lack of accumulation marks a pause following a large bitcoin purchase earlier in December.

Strategy has historically relied on equity and debt issuance to fund bitcoin acquisitions. The absence of new purchases suggests a tactical pause, rather than a change in long-term strategy.

Strategy’s dollar reserves

The company first disclosed the establishment of a dedicated U.S. dollar reserve on Dec. 1, when the balance stood at $1.44 billion. The reserve is intended to support preferred dividend payments, service debt obligations, and manage short-term volatility.

The increase to $2.19 billion strengthens Strategy’s near-term financial flexibility.

Management did not specify how or when the cash will be deployed. In prior filings, Strategy has said capital raises are designed to support long-term bitcoin accumulation while maintaining sufficient liquidity to operate through market cycles.

The continued use of at-the-market offerings underscores Strategy’s active engagement with capital markets.

While bitcoin holdings were unchanged during the week, the company reiterated its commitment to transparency by publishing regular updates through its investor dashboard and SEC filings.

MSCI and Strategy

All this is happening while MSCI considers a rule change that could reshape how crypto-heavy companies are treated in global equity markets. MSCI is weighing whether to remove firms like Strategy from its major indexes if more than 50% of their assets are held in digital assets, arguing that these companies resemble investment funds rather than operating businesses.

Under the proposal, firms classified as “Digital Asset Treasury” companies would be excluded to preserve benchmark integrity and limit volatility. Strategy, the largest corporate holder of bitcoin, sits at the center of the debate, but several other companies with similar balance-sheet strategies could also be affected.

Strategy has formally pushed back, calling the 50% threshold arbitrary, discriminatory, and unworkable. The company argues it is an operating technology business building digital credit and financial infrastructure, not a passive crypto vehicle.

Analysts and industry participants have also criticized the proposal, warning that exclusion could force index funds to sell billions of dollars’ worth of shares.

Estimates suggest potential outflows of $2.8 billion to $9 billion for Strategy alone, and $10 billion to $15 billion across the sector. MSCI is expected to decide by January 15, 2026, ahead of a potential February index implementation.

The outcome of this decision could send shockwaves through the market and potentially impact Bitcoin price performance over the coming months.

Earlier today, Citigroup cut its price target on MicroStrategy to $325 per share from $485. The bank maintained its buy rating on the stock. At the time of writing, Bitcoin is trading near $90,000.

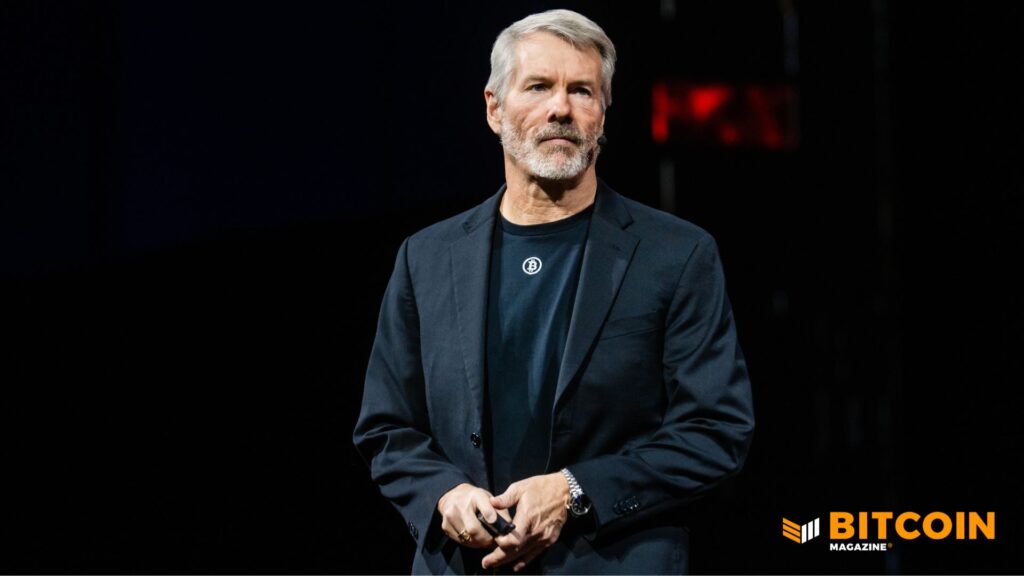

Michael Saylor at BTC Inc’s Bitcoin Amsterdam Conference

Michael Saylor at BTC Inc’s Bitcoin Amsterdam Conference

This post Bitcoin-treasury Strategy Boosts Cash Reserve to $2.19 Billion, Pauses BTC Buying first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

You May Also Like

CEO Sandeep Nailwal Shared Highlights About RWA on Polygon

Laser Cutting Services San Diego: Precision Solutions for Modern Manufacturing