- Meme coin market rose to $150 billion in December 2024.

- Market fell to approximately $39 billion by November 2025.

- Notable influence on cryptocurrency market sentiment and investments.

Meme Coin Market Dynamics

Meme Coin Market Dynamics

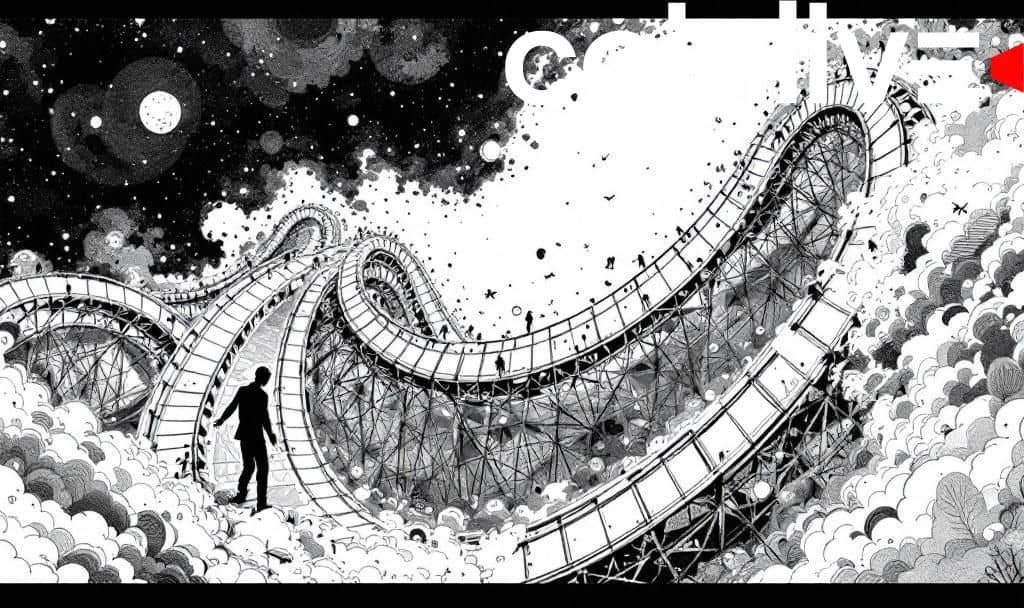

Meme coins rocket to a $150 billion cap in December 2024, facing a dramatic market turnaround as values plummet to $39-47 billion by late November 2025.

This downturn highlights the volatility of meme coins, urging market players to reassess speculative investments.

The meme coin market experienced a significant surge, reaching $150 billion in December 2024. This marked an all-time high for the sector. It was a remarkable achievement considering the prior valuations of these largely speculative assets.

Various meme coins saw investments driven by community enthusiasm and social media campaigns.

The market’s rapid ascent highlighted the growing interest in alternative cryptocurrencies. This movement attracted both retail and speculative investors eager for high returns.Market Volatility and Risks

Despite the initial euphoria, the market experienced volatility, with values dropping to around $39 billion by November 2025. This decline indicated the inherent risks associated with meme coins. Investors and enthusiasts were undoubtedly impacted by the decrease in valuations.

Financially, the crypto market endured disruptions impacting investor confidence. The falloff prompted discussions around the sustainability of meme coins and their long-term viability. The swift changes caught the attention of financial analysts and market pundits alike.

Strategic Re-evaluations and Future Prospects

Industry stakeholders were forced to re-evaluate strategies surrounding meme coin investments. Despite setbacks, proponents argue that meme coins remain a vibrant part of the crypto landscape. They underscore the potential for volatile yet high-yield opportunities.

Future financial outcomes could hinge on regulatory scrutiny and technological advancements within the crypto ecosystem. Historical volatility suggests that meme coins will remain sensitive to market sentiment and regulatory developments. This could shape investment strategies going forward.