Midnight (NIGHT) Price: Cardano Privacy Token Reaches Record High on Heavy Volume

TLDR

- Midnight (NIGHT) token rallied 42-47% in 24 hours, reaching a new all-time high near $0.096-$0.12

- Trading volume exceeded $7 billion, making NIGHT the fourth most traded cryptocurrency globally

- The token shows low correlation with Bitcoin, allowing it to move independently during market uncertainty

- Major exchange listings on Binance, Bybit, and Kraken improved liquidity and price discovery

- Midnight is Cardano’s first privacy-focused partner chain using zero-knowledge proofs, linked to founder Charles Hoskinson

Midnight price jumped to a new all-time high on Friday as heavy trading pushed the privacy token past previous resistance levels. The rally came after several major exchange listings expanded access for traders.

Midnight (NIGHT) Price

Midnight (NIGHT) Price

NIGHT traded near $0.093 to $0.10 during active sessions. The token touched an intraday peak close to $0.12. This marked the highest price since the project launched.

Trading volume crossed $7 billion over 24 hours. This placed Midnight as the fourth most traded cryptocurrency by volume. The token surpassed Solana’s $2.74 billion, XRP’s $2.41 billion, and BNB’s $1.59 billion in daily turnover.

The price increase ranged from 36% to 47% depending on the timeframe measured. Both retail and institutional traders participated in the rally. Order flow data showed aggressive buying across multiple trading venues.

Exchange Listings Drive Liquidity Growth

Recent listings on Binance, Bybit, and Kraken improved market conditions for NIGHT. Order book depth increased across these platforms. Bid-ask spreads narrowed during high-volume periods.

These improvements helped support efficient price discovery. Traders could execute larger orders with less slippage. The expanded access brought new capital into the token.

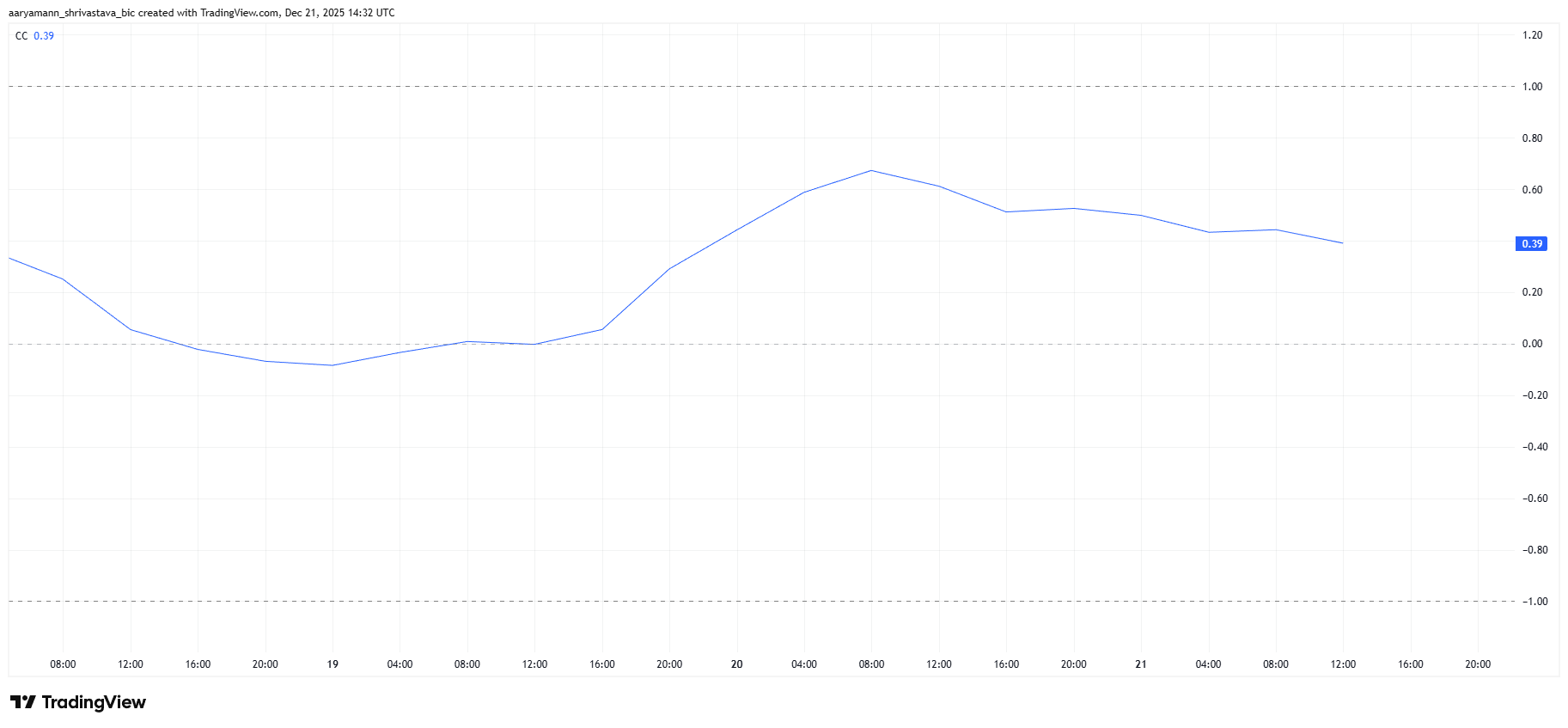

Chaikin Money Flow indicator remained in positive territory above the zero line. This confirmed net inflows continued despite some profit-taking. The metric dipped slightly over 48 hours but stayed supportive.

Bitcoin Independence and Technical Structure

NIGHT shows weak correlation with Bitcoin price movements. This allows the token to trend independently during periods of Bitcoin consolidation. BTC has struggled to regain clear upward momentum recently.

Source: TradingView

Source: TradingView

The low correlation benefited NIGHT as it climbed while broader markets remained uncertain. Technical analysis showed the token broke above its upper trendline on four-hour charts. Support levels formed in the $0.085 to $0.09 range.

Analysts identified $0.075 as a key support zone. Holding above this level maintains the current structure. A break below could lead to further downside toward $0.060.

Midnight operates as Cardano’s first privacy-focused partner chain. The network uses zero-knowledge proofs for programmable data protection. This technology allows for privacy while maintaining compliance capabilities.

The project’s association with Cardano founder Charles Hoskinson increased visibility. This connection attracted investors familiar with Cardano’s research-driven approach. Capital continued flowing into NIGHT despite some divergence from Cardano’s main chain metrics.

Cardano’s total value locked decreased slightly in recent sessions. Some analysts suggested capital may be rotating from Cardano DeFi protocols into Midnight markets. This pattern appears common with new token listings.

Derivatives data showed moderate leverage usage among NIGHT traders. This reduced immediate liquidation risk during potential pullbacks. On-chain metrics supported continued strength with limited selling pressure detected.

NIGHT reached an intraday all-time high of $0.096 to $0.12 with volume exceeding $7 billion across global exchanges.

The post Midnight (NIGHT) Price: Cardano Privacy Token Reaches Record High on Heavy Volume appeared first on CoinCentral.

You May Also Like

MFS Releases Closed-End Fund Income Distribution Sources for Certain Funds

BlackRock boosts AI and US equity exposure in $185 billion models