Top 4 Banking Tokens Built for the Stablecoin Boom – Digitap ($TAP) Is Best Crypto to Buy 2026

The post Top 4 Banking Tokens Built for the Stablecoin Boom – Digitap ($TAP) Is Best Crypto to Buy 2026 appeared first on Coinpedia Fintech News

Crypto markets remain under pressure as Bitcoin (BTC) and major altcoins like SOL, ETH, and XRP struggle to sustain upside momentum. Persistent volatility and tightening liquidity are draining speculative conviction, pushing investors to search for assets with stronger fundamentals and real-world use cases.

As price uncertainty grows, stablecoins are gaining traction as reliable tools for payments, remittances, and capital preservation. This shift is redirecting attention toward banking-focused tokens that power stablecoin infrastructure rather than speculative price-driven narratives.

That rotation has put Digitap ($TAP) firmly on investors’ radar. Positioned as a banking-focused crypto platform enabling everyday spending and seamless crypto-to-fiat interaction, Digitap is gaining recognition as one of the best cryptocurrencies to buy for 2026. Now in its presale stage at a discounted price of $0.0383, $TAP is attracting early capital seeking exposure to scalable banking rails ahead of the next market cycle.

Here are the top 4 banking tokens in the current competitive cryptocurrency market:

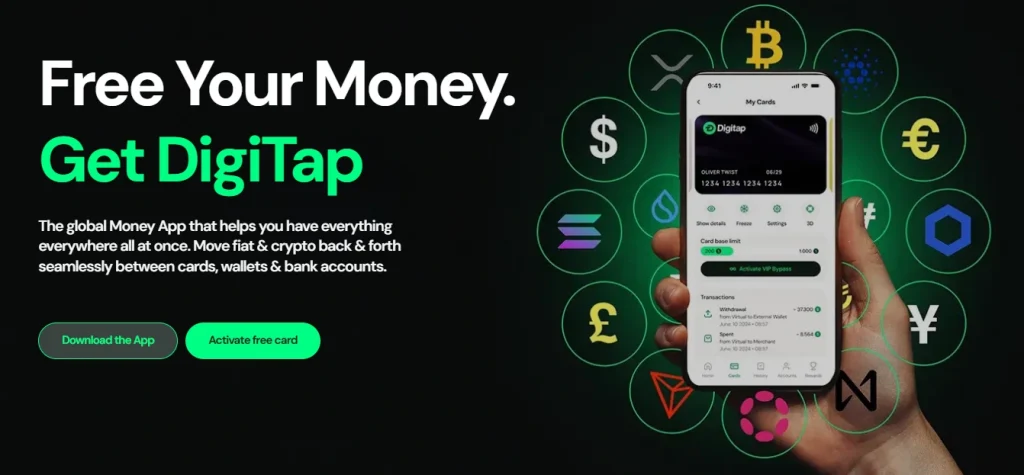

1. Digitap: The One-Stop Shop for Banking Infrastructures

The broader market attention has turned to early-stage crypto tokens like $TAP, which bypass short-term volatility by anchoring its value proposition in financial utility. Digitap stands out for building purpose-built banking infrastructure tailored to the stablecoin boom.

Instead of competing on narrative-driven hype, Digitap is focused on its hybrid infrastructure, which enables everyday financial activity, including payments, transfers, and global account access, using stablecoins as the settlement layer.

The protocol is packed with a wide range of functionalities, positioning it as one of the best altcoins. Still in its early stages, Digitap operates a live app, currently available in app stores. It allows users to manage a single wallet for all their crypto portfolio, operating, and offshore accounts with a seamless experience.

Digitap is also offering its users a no-KYC visa card, which is available in both virtual and physical formats. This gives users a seamless experience when using stablecoins for online and in-store purchases.

A look at $TAP’s presale figures shows that the token is currently priced at $0.0383, and the ongoing presale round is approximately 58% complete as it approaches $3 million in token sales. Investors are taking advantage of this opportunity because the next round comes with a fixed price increase of $0.0399 per token.

2. Nexo: Centralized Financial (CeFi) Products Marketplace

NEXO, the native and governance token of the Nexo crypto financial platform, which allows users to borrow against crypto, earn interest on deposits, and access different Centralized Financial (CeFi) products.

Unlike decentralized finance (DeFi) tokens, NEXO’s value comes from participating actively on the app. When users hold the tokens, their loyalty status increases, as interest accumulates on savings, while reducing the borrowing costs and enabling active members to vote.

Nexo used to share its profits as dividends to token holders; however, it had to change this model to comply with U.S. regulations. Now, it gives out daily interest of up to 12% APY, making the rewards more predictable and compliant. This makes the token naturally stand out as one of the best altcoins to watch in this season.

3. XDC Network: Tokenize Real-world Assets Access

XDC Network (XDC) is an enterprise-focused blockchain designed to digitize trade finance and tokenize real-world assets (RWAs) through high-speed, compliant infrastructure that bridges traditional finance with decentralized solutions.

The network focuses on trade finance, cross-border payments, and supply chain solutions, with the aim of digitizing and streamlining global commerce using the blockchain. Its native token XDC is used to pay for transactions, for staking, and participating in network governance.

Also, it uses a hybrid system that combines public transparency with private subnets, allowing enterprises to control privacy while maintaining public immutability. With its fast settlement times, XDC positions itself as one of the best cryptos pushing for a stablecoin boom globally.

4. Swissborg: Multi-chain DeFi App

Swissborg ($BORG) is a governance token that bridges traditional finance with decentralized finance (DeFi). The token originally launched in 2017 as CHSB, but it later migrated in 2023 to BORG to expand its utility and support multi-chain access while preserving total supply and continuity for holders.

The protocol functions are designed to give active users incentives for holding or locking BORG and up to 90% cashback on trading fees. Also, users can vote on key decisions like fee structure, buyback, allocations, and ecosystem development through community proposals.

Swissborg exemplifies one of the top altcoins investors are watching in 2025. However, at the heart of these banking tokens is Digitap. Still at its presale stage, the token combines real-world utility with a working product.

Why is $TAP the Best Crypto to buy in 2026?

The top banking protocols serve a specific niche, but their value propositions differ materially when measured against adoption readiness and market timing. While NEXO is a mature CeFi platform, its upside is limited by regulation and a saturated user base.

Meanwhile, XDC Network targets enterprises and trade finance, a long-cycle adoption market that limits near-term retail participation. Swissborg focuses on governance and yield incentives, but remains tightly coupled to market conditions and platform activity.

Digitap occupies a distinct, more asymmetric position, making it the best altcoin to watch. It is in an early stage, the product is live, and directly aligned with the stablecoin adoption curve. Unlike its peers, Digitap combines crypto banking, offshore accounts, and Visa-style card spending into a single ecosystem built for daily financial use, not just yield, governance, or enterprise tooling.

Critically, Digitap is not waiting for adoption to begin. The app is already live, the cards are usable, and the infrastructure supports real transactions today. This places $TAP at the intersection of stablecoin growth and real-world payments, a segment expected to expand regardless of broader market cycles.

From an investment standpoint, $TAP offers the most favourable presale pricing at $0.0383, with a proposed listing price of $0.14. Investors have concluded that $TAP is the best crypto to buy in 2026.

What’s more, Digitap is currently running its 12 Days of Christmas festive rewards campaign, offering random prizes each day throughout the promotion period and completely free to participate in.

Digitap is Live NOW. Learn more about their project here:

- Presale https://presale.digitap.app

- Website: https://digitap.app

- Social: https://linktr.ee/digitap.app

- Win $250K: https://gleam.io/bfpzx/digitap-250000-giveaway

You May Also Like

Fed Decides On Interest Rates Today—Here’s What To Watch For

Tokenization Could Disrupt Finance Faster Than Digitization Hit Media, MoonPay President Says