Bitcoin Cash Price Targets $600 Zone Amid Rising Retail Demand

Highlights:

- Bitcoin Cash price has risen 10% to $592, as bullish sentiment builds in the market.

- The BCH derivatives data indicate a surge in retail interest as the OI increases by 25%.

- The technical outlook shows positive momentum, as Bitcoin Cash price targets $600 soon.

The Bitcoin Cash (BCH) has risen by 5% to $592 despite the inflation in the US economy remaining low. According to derivatives data, there is high retail interest with BCH Open Interest hitting a 6-month high. The technical perspective of Bitcoin Cash shows a potential breakout above $600, and the bulls are targeting $625.

Meanwhile, the Bitcoin Cash price has rallied despite the November CPI statistics of the US, which were 2.7% on Wednesday. The token has also ignored that the Bank of Japan increased its rates by a quarter-point to 0.75, the highest levels in 30 years. The retail mood of BCH gets stronger as the retail nears the breakout level.

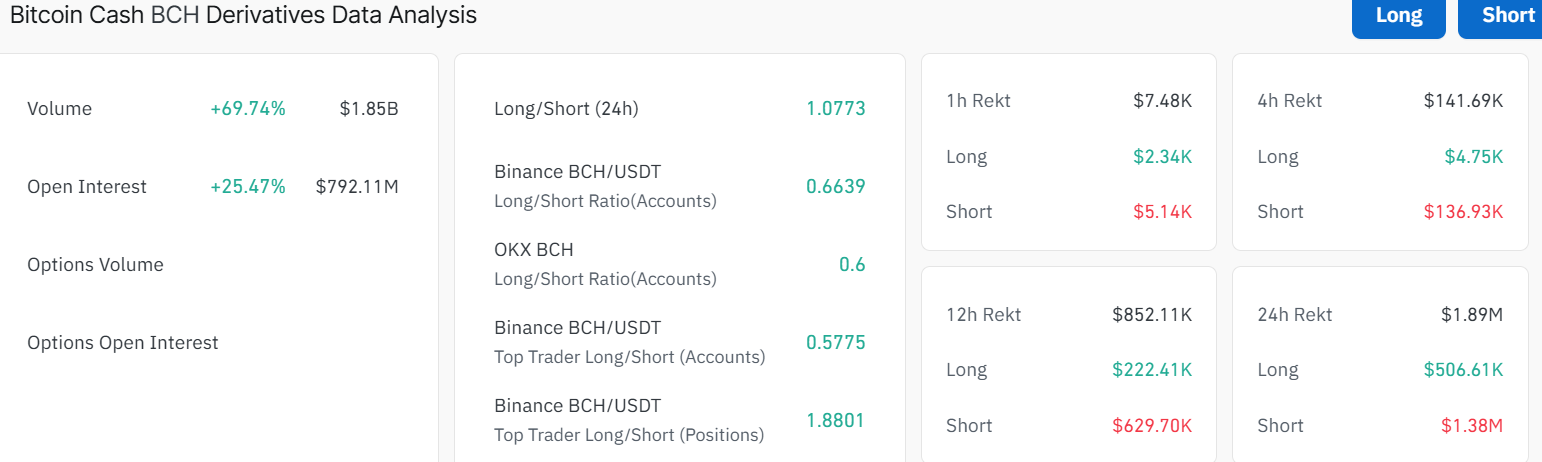

According to CoinGlass, the BCH futures Open Interest (OI) has increased by 25% in the past 24 hours to a new high of $761.48 million. This marks a significant rise in capital exposure as risk-on sentiment re-enters the market. Also, the long-to-short ratio has surged past one at 1.0773. This means that the bullish grip is strengthening in the BCH market.

Bitcoin Cash Derivatives Data: CoinGlass

Bitcoin Cash Derivatives Data: CoinGlass

Bitcoin Cash Price Targets $600 as Bullish Grip Strengthens

The Bitcoin Cash price currently trades close to $592 and has strong support near the 50-day moving average at about $535 and 200-day-day at $534. These moving averages act as a price floor, preventing major price dips. At the same time, resistance lingers near the $600 level, which Bitcoin Cash needs to breach for upward momentum. If it succeeds, the next major target could lie near the $625-$632 zone.

The momentum indicators are now bullish. The Relative Strength Index is at 58.46, indicating surging buying pressure. The MACD indicator hints at mild bullish momentum, with the MACD line showing a looming buying signal once it crosses above the signal line. This shows that the bulls are building momentum for a breakout above $600 soon.

BCH/USD 1-day chart: TradingView

BCH/USD 1-day chart: TradingView

Looking ahead, if BCH’s price falls below $535 support, traders will look at the next support at $534. These levels may stop further falls. But if those break too, the price could fall to $523 before the bulls regroup for a rebound. However, with the rising demand and positive momentum, the bulls are eyeing a potential breakout to $600 soon. In the meantime, traders should look for a clear break above $600 to know what may happen next.

If the price keeps going up, more buyers may come in and push Bitcoin Cash toward its $625. The mix of a good technical setup makes BCH an interesting coin to watch for those following crypto’s future growth. While the price is still testing important levels, the outlook for BCH looks hopeful as it stands to benefit from the positive sentiment building in the market.

eToro Platform

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

You May Also Like

Regulation Advances While Volatility Masks the Bigger Picture

Grayscale ETF Tracking XRP, Solana and Cardano to Hit Wall Street After SEC Pause