Aster Confirms Stage 5 Token Airdrop for 2025: What Users Need to Know

This article was first published on The Bit Journal.

Aster price remains under pressure as the project shifts its airdrop strategy and prepares to launch its own blockchain. The latest changes focus on lower emissions and tighter supply control.

At the same time, market indicators show traders acting with caution. This mix of long-term planning and short-term weakness continues to shape sentiment around Aster price.

Aster’s Token and Network Roadmap

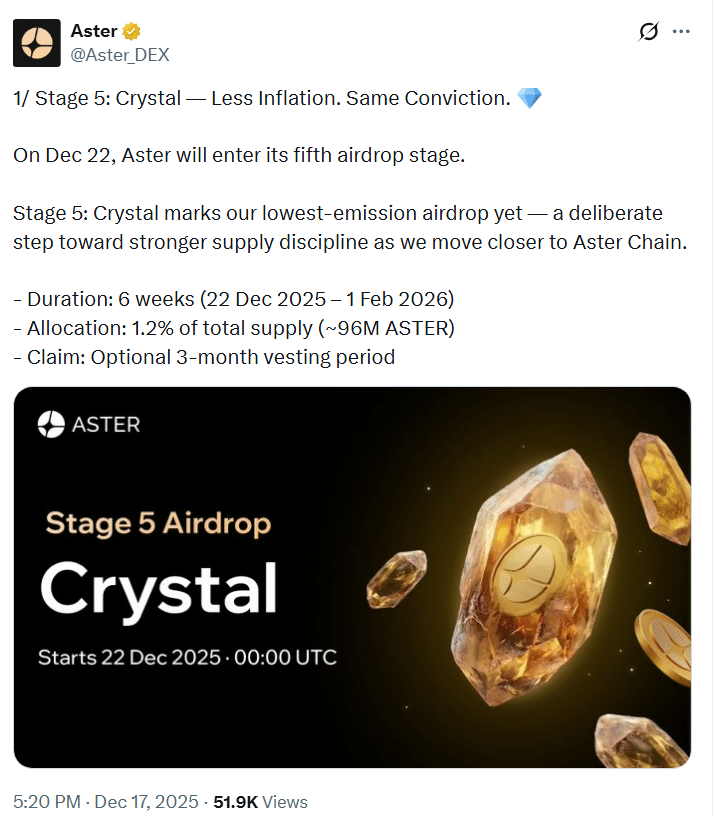

Aster announced the start of its fifth airdrop phase, called Crystal. The update also included clarification on buybacks and progress toward the Aster Chain launch.

These developments mark a transition away from aggressive distribution. They also set new expectations for how Aster price may respond to supply and demand changes.

Source: X

Source: X

Crystal Airdrop Timeline and Supply Impact

The Crystal airdrop will begin on Dec. 22 and end on Feb. 1, 2026. It will distribute 1.2% of the total token supply. That equals roughly 96 million tokens.

Also Read: Aster Announces Ambitious 2026 Roadmap With New Layer-1 Blockchain

This is the smallest airdrop allocation the project has released so far. The reduced issuance reflects a more conservative approach that could influence Aster price stability over time.

Crystal Airdrop Structure and Token Allocation Design

The airdrop allocation is split evenly. Half of the tokens are available immediately as a base claim. The other half is offered as a bonus that unlocks after a three-month vesting period.

Users must choose between claiming early or waiting. This decision directly affects how much supply enters the market and may impact Aster price movements.

Burn Mechanism Introduces Deflationary Supply Dynamics

Early claims come with a penalty. Users who claim before vesting ends lose the bonus portion. That bonus is permanently burned.

Aster said the goal is to reduce post-airdrop selling pressure. By tying burns to early claims, the project introduces a deflationary element that could support Aster price in the longer term.

Participation Rules and Eligibility Criteria Remain Consistent

Participation rules have not changed in a major way. Based on earlier stages, eligibility is expected to depend on platform activity. This often includes perpetual trading volume and engagement levels.

Final eligibility criteria and claiming tools will be released closer to launch. Until then, uncertainty around participation continues to weigh on Aster price sentiment.

Progress Toward Aster Chain and Layer-1 Network Launch

Stage 5 also aligns with the upcoming launch of Aster Chain, the project’s layer-1 blockchain. A testnet is scheduled for late December. The main network is expected to launch in the first quarter of 2026.

Staking and governance tools are planned for the second quarter. Owning its own chain allows Aster to manage fees and upgrades directly, which could tie Aster price more closely to real network usage.

Buyback Program Update and Capital Deployment Details

Aster also addressed confusion around its buyback program. The team said Stage 4 buybacks were accelerated in early December. Around $32 million was executed over eight days. This used about 90% of accumulated Stage 4 fee income.

Buybacks resumed on Dec. 17 and will continue through Dec. 21. While buybacks can support Aster price, their effect has been limited by broader market weakness.

Technical Outlook Shows Continued Downside Risk

From a technical perspective, Aster price continues to trade inside a clear descending channel. This pattern reflects sustained bearish control. At press time, price hovered near $0.76.

It remained below the 1.618 Fibonacci level at $0.836. Downside targets sit at $0.741, $0.646, and $0.588. The MACD remains negative, suggesting limited upside momentum for Aster price.

Source: TradingView

Source: TradingView

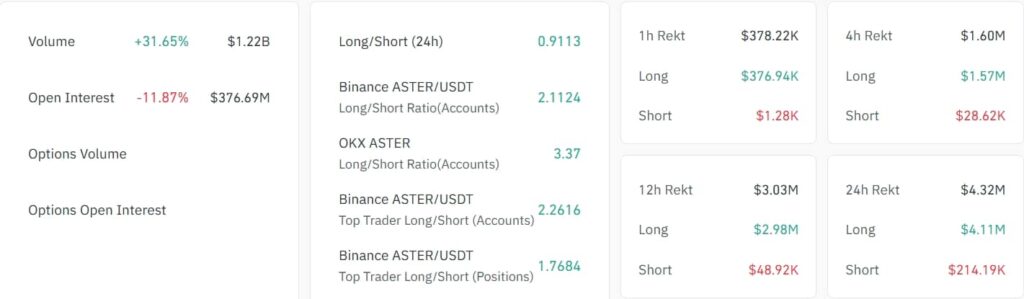

Derivatives Data Highlights Cautious Market Sentiment

Open interest dropped 3.92% to $420.8 million. This decline suggests traders are reducing exposure rather than adding positions.

The move followed whale exits and shrinking demand across leverage markets. Lower open interest reduces liquidation risk but also signals weak conviction, which continues to pressure Aster price.

Source: Coinglass

Source: Coinglass

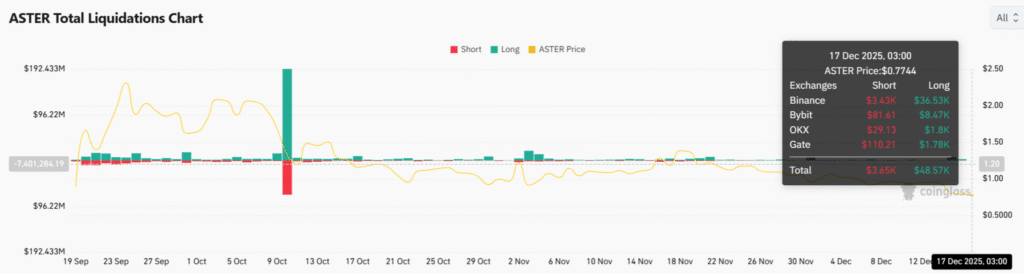

Liquidation Trends Reinforce Bearish Market Control

Liquidation data shows stronger losses on the long side. Long liquidations reached $48.57K, while short liquidations stood at $3.65K. This imbalance reflects weak confidence among leveraged buyers.

Selling pressure is being absorbed smoothly, without sharp volatility spikes. These conditions often support gradual downside moves in Aster price.

Source: Coinglass

Source: Coinglass

Conclusion

Aster is restructuring its token model through lower emissions, burn mechanisms, and a new blockchain. These changes strengthen long-term fundamentals.

However, market participants remain cautious in the near term. Until technical levels improve and network utility becomes visible, Aster price is likely to face continued pressure.

Also Read: ASTER Price Prediction: Will CZ’s $2M Buy Push ASTER to $1.25?

Appendix: Glossary of Key Terms

Airdrop: The issuance or distribution of a new cryptocurrency to individuals who have existing access to another blockchain.

Token Emissions: The supply of new tokens entering circulation per unit time.

Vesting Period: The duration of time that tokens are held, except for being unlocked.

Token Burn: Permanently destroying tokens to remove them from circulation and decrease the total supply.

Layer-1 Block-Chain: A fundamental block-chain network that performs transactions and protects its ecosystem.

Open Interest: The total value of derivatives contracts not yet closed.

Descending Channel: A technical chart pattern defined by lower highs and lower lows.

Liquidation: The forced closure of leveraged positions when margin requirements are not met.

Frequently Asked Questions About Aster Price

1- What is affecting Aster price right now?

Aster price is influenced by bearish technical patterns, declining open interest, and cautious trader sentiment.

2- What is the Crystal airdrop phase?

It is Aster’s fifth airdrop phase, distributing 1.2% of total supply with a burn option for early claims.

3- How does the burn mechanism work?

Users who claim early lose the vesting bonus, which is permanently burned.

4- When will the Aster Chain launch?

The mainnet is expected in Q1 2026, with staking and governance features planned for Q2.

References

CryptoNews

AMB Crypto

Read More: Aster Confirms Stage 5 Token Airdrop for 2025: What Users Need to Know">Aster Confirms Stage 5 Token Airdrop for 2025: What Users Need to Know

You May Also Like

Unexpected Developments Shake the Financial Sphere

Foreigner’s Lou Gramm Revisits The Band’s Classic ‘4’ Album, Now Reissued