Michael Saylor’s $1T Bitcoin Goal Propels L2 Scaling Solution Bitcoin Hyper

Michael Saylor’s $BTC ambitions continue accelerating. Now, he plans for his company – Strategy (formerly MicroStrategy) – to stack up $1T of the world’s largest crypto asset.

Even as critics get louder about the company’s $BTC buying strategy, Saylor seems unfazed.And as more $BTC is scooped up, projects building on Bitcoin, such as Bitcoin Hyper, are bound to see their utility and demand accelerate.

Bitcoin Hyper is a Layer-2 (L2) scaling solution being developed to address the Bitcoin network’s pain points, of which is particularly useful during peak demand, after all.

Strategy’s $47.35B $BTC Stash Generates $25B in Returns

In 2020, Strategy boldly pivoted from business software to a digital asset-focused balance sheet. And boy, has it paid off. The company is now the largest corporate holder of $BTC worldwide.

Currently, it holds a total of 640,031 $BTC, following a recent purchase of 196 $BTC worth approximately $22.1M.The total stash was accumulated for roughly $47.35B at an average price of about $73,983. But with $BTC now trading at $114K, Strategy is sitting on over $25B in unrealized gains.

Regardless of the humongous profit, Strategy’s large $BTC buys receive backlash. Take short-seller Jim Chano, for instance. He slammed the company’s valuation by calling it ‘financial gibberish.’

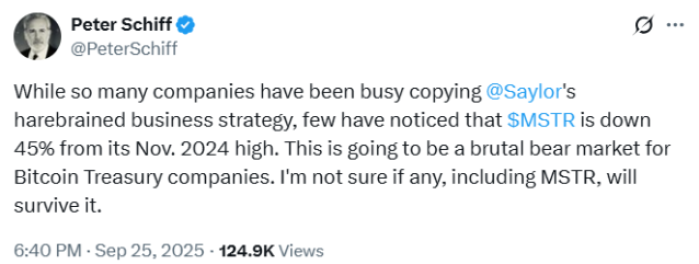

Not helping matters, Chanos argues that Strategy’s market cap shouldn’t exceed the value of its $BTC holdings. Yet, in June, the company’s $108B valuation was around 1.74x its $62.27B worth of $BTC – a cap critics say creates an arbitrage opportunity.Peter Schiff, chief economist at Euro Pacific Capital, also criticizes Strategy. In an X post last week, he called the firm’s approach ‘harebrained’ and noted that Strategy ($MSTR) is down 45% from its November 2024 peak.

Still, ongoing criticism doesn’t deter other firms from betting big on the crypto king.

108 Public Companies Now Hold $119.5B Worth of $BTC

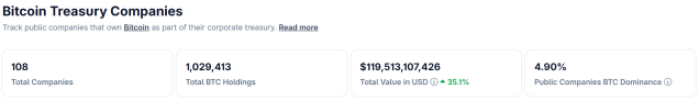

CoinMarketCap data shows that 108 public companies now hold 1,029,413 $BTC worth over $119.5B – 4.90% of the asset’s total supply.

Behind Strategy, MARA Holdings is the second-largest $BTC treasury, holding 52,477 $BTC, valued at over $6B.

Meanwhile, XXI is firmly in third place, holding 43,514 $BTC worth roughly $5.05B.

These companies, along with others like Metaplanet (which recently established a US subsidiary to expand its $BTC income business), view the crypto leader as a long-term investment with high profit potential.

But as more capital flows into the Bitcoin ecosystem, the network often becomes congested. In turn, this results in slow transaction speeds, high fees, and thus a less-than-ideal setup for investors.

This is where Bitcoin Hyper steps in.

Bitcoin Hyper to Make Bitcoin as Efficient as Solana

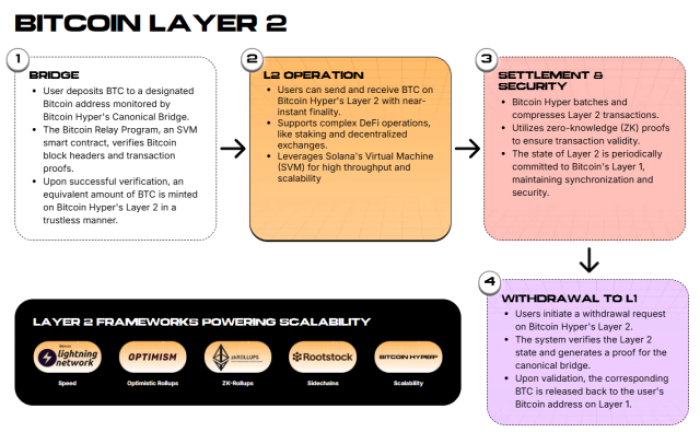

Bitcoin Hyper is on a mission to address the Bitcoin network’s biggest limitations through its upcoming L2 solution.

Once launched this quarter, it’ll leverage the Solana Virtual Machine (SVM) to make the network faster, cheaper, and more scalable. And at Solana-level speeds, of course.

And it’s no wonder that the L2 aims to match the speed of the second largest blockchain with $11.629B Total Value Locked (TVL).

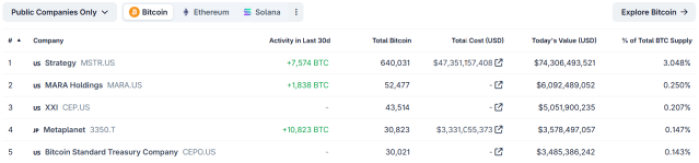

Right now, Bitcoin can only process 4.2 transactions per second (tps), a sizable ~18,521% less than Solana’s 782.1 tps.In fact, Solana far outpaces Bitcoin in many key performance areas. The network’s maximum throughput reaches 4,709 tps, roughly 357x higher than Bitcoin’s 13.2 tps peak.

The gap is even wider in theoretical capacity; Solana can handle up to an eye-boggling 65K tps versus Bitcoin’s 7 tps.

And that’s not all. Solana’s block time average is much higher at 0.39 seconds compared to Bitcoin’s 9 minutes and 35 seconds.

The time it takes for a transaction to be fully confirmed on Solana is also just 12.8 seconds, nearly 100% shorter than Bitcoin’s one hour.But it’s not just the utilization of the SVM that’ll make the L2 more scalable – the addition of a Canonical Bridge will help, too.

The bridge will enable the movement of wrapped versions of $BTC across the Bitcoin mainnet and the L2 network. In doing so, $BTC can be used across DeFi, dApps, NFTs, and other Web3 ecosystems at a fast pace.

Not only will it unlock new use cases previously unseen on Bitcoin, but it will also bring greater liquidity.

Plus, all will be achieved while preserving the security of Bitcoin’s base layer, a strength the network doesn’t lack.

Its Proof-of-Work (PoW) consensus, tremendous global mining network, and decentralized validator base make the network highly resistant to attacks and manipulation.As a consequence, you can rest easy knowing that the L2 is building on one of the most secure and battle-tested networks in the entire blockchain sector.

$HYPER Powers the Bitcoin L2’s Utility, Scalability & Growth

At the core of the entire ecosystem is $HYPER, the project’s native token that drives utility, sustainability, and scalability.

The reason is that a hefty 30% of its total token supply is earmarked to fund ongoing development, while an extra 25% is reserved for the ecosystem treasury.

To top it off, purchasing $HYPER on presale – currently available for just $0.013005 – opens an abundance of additional perks.

Whether you’re after lower gas fees, governance rights, or passive income at a 60% APY through staking (or all three!), holding $HYPER opens attractive, exclusive benefits for all.If you’re interested in staking for gains, there’s no better time to do precisely that; the APY will drop as more investors catch on.

Our Bitcoin Hyper price prediction also anticipates $HYPER to reach $0.32 after it’s listed on some of the best crypto exchanges. This alone could generate over 24x returns, and that’s without factoring in any staking income.

Weighing all these points together, it makes perfect sense that $HYPER has already raised over $19.5M, recently backed by three major whale buys: $113.8K, $109.9K, and $105.4K.

Join Bitcoin Hyper today.

Disclaimer: The information provided is solely for educational and informational purposes. We’re not financial advisors, so always do your own research and don’t invest more than you’d be sad to lose. Crypto investments are highly volatile and can carry significant risks.

Authored by Leah Waters, Bitcoinist – https://bitcoinist.com/saylor-trillion-dollar-bitcoin-empire-pumps-hyper

You May Also Like

Moto completes $1.8 million pre-seed funding round for its Solana eco-credit card project.

Whales Dump 200 Million XRP in Just 2 Weeks – Is XRP’s Price on the Verge of Collapse?